Analysts See Significant Upside for Vanguard High Dividend Yield ETF

In our analysis of ETFs, we examined the underlying holdings of the Vanguard High Dividend Yield ETF (Symbol: VYM). By comparing the trading price of each holding to the average 12-month forward target price set by analysts, we calculated a weighted average implied target price for VYM itself. The result shows an implied analyst target price of $141.99 per unit.

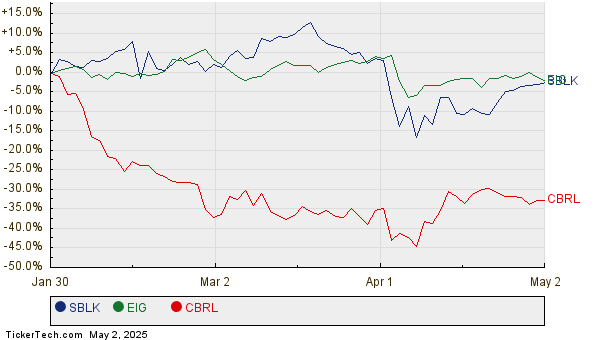

Currently, VYM is trading at approximately $123.96. This indicates potential for a 14.54% upside, as suggested by analysts when looking at the average target prices of its underlying holdings. Notably, three holdings show significant upside potential based on analyst targets: Star Bulk Carriers Corp (Symbol: SBLK), Employers Holdings Inc (Symbol: EIG), and Cracker Barrel Old Country Store Inc (Symbol: CBRL).

Star Bulk Carriers Corp recently traded at $14.80 per share. Analysts have set an average target price of $21.04, showcasing a potential upside of 42.16%. Employers Holdings Inc shows an 18.53% upside from its recent price of $48.09, with a target set at $57.00. Cracker Barrel’s recent price of $42.64 suggests a potential increase of 17.59%, as analysts project a target of $50.14. Below is the twelve-month price history chart illustrating the performance of SBLK, EIG, and CBRL:

Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard High Dividend Yield ETF | VYM | $123.96 | $141.99 | 14.54% |

| Star Bulk Carriers Corp | SBLK | $14.80 | $21.04 | 42.16% |

| Employers Holdings Inc | EIG | $48.09 | $57.00 | 18.53% |

| Cracker Barrel Old Country Store Inc | CBRL | $42.64 | $50.14 | 17.59% |

These price targets raise questions about whether analysts’ expectations are justified or overly optimistic. Investors may wonder if the targets are based on sound analysis or if they lag behind recent developments in the companies and their industries. A higher price target compared to a stock’s current trading price can signal optimism, but it may also precede potential downgrades if the targets fail to align with market realities. Further research is advised for investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.