Analyst Predictions Show Upside Potential for Dimensional US Large Cap Value ETF

At ETF Channel, we analyzed the underlying holdings of ETFs within our coverage universe. We compared the trading price of each holding to the average analyst’s 12-month forward target price. For the Dimensional US Large Cap Value ETF (Symbol: DFLV), the implied analyst target price based on its holdings is $35.66 per unit.

Currently, DFLV is trading at approximately $30.27 per unit. This suggests that analysts see a potential upside of 17.79% for the ETF based on the average target prices of its underlying holdings. Notably, three of DFLV’s holdings, Warner Bros Discovery Inc (Symbol: WBD), Autoliv Inc (Symbol: ALV), and Liberty Media Corp – Formula One Group (Symbol: FWONA), exhibit significant upside potential relative to their current prices. Specifically, WBD’s recent price of $10.59 per share has an average analyst target of $12.69, reflecting a 19.86% upside. Similarly, ALV, trading at $95.76, has a target price of $114.38, suggesting a 19.44% potential gain. Additionally, FWONA’s recent price of $77.96 correlates with an expected target of $93.00, marking a 19.29% upside.

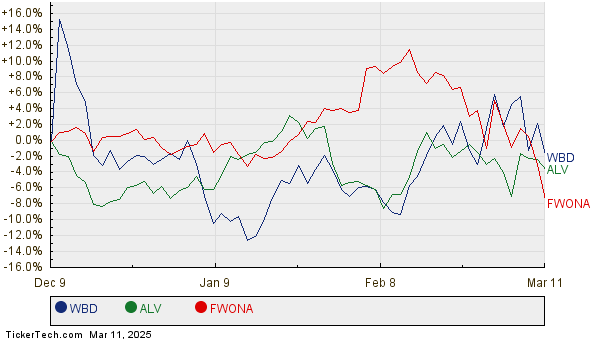

For a visual perspective, below is a twelve-month price history chart comparing the performance of WBD, ALV, and FWONA:

Below is a summary of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Dimensional US Large Cap Value ETF | DFLV | $30.27 | $35.66 | 17.79% |

| Warner Bros Discovery Inc | WBD | $10.59 | $12.69 | 19.86% |

| Autoliv Inc | ALV | $95.76 | $114.38 | 19.44% |

| Liberty Media Corp – Formula One Group | FWONA | $77.96 | $93.00 | 19.29% |

These target prices raise questions about the analysts’ assumptions. Are they justified, or are they overly optimistic regarding potential future trading prices? Investors should consider whether these targets are based on solid fundamentals or if they may need adjustments due to recent industry and company developments. High price targets can indicate enthusiasm about the future but may also lead to downgrades if they more closely reflect outdated expectations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Cheap Stocks

• Top Ten Hedge Funds Holding HQI

• RMI Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.