Analysts See Potential Upside for iShares Russell 1000 Value ETF

According to our analysis at ETF Channel, we reviewed the underlying holdings of various ETFs. We compared the trading prices of these holdings against the average analyst 12-month forward target prices and calculated the weighted average implied analyst target price for the ETF itself. For the iShares Russell 1000 Value ETF (Symbol: IWD), the implied analyst target is set at $218.04 per unit.

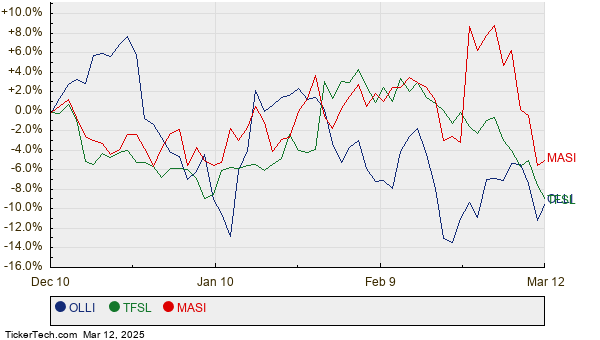

Currently, IWD is trading near $184.67 per unit. This indicates an 18.07% upside potential for the ETF, based on analysts’ targets for its underlying holdings. Notable underlying assets contributing to this outlook include Ollie’s Bargain Outlet Holdings Inc (Symbol: OLLI), TFS Financial Corp (Symbol: TFSL), and Masimo Corp. (Symbol: MASI). While OLLI recently traded at $101.08 per share, analysts project a 20.83% increase, aiming for a target of $122.13 per share. In a similar vein, TFSL shows a 20.03% upside from its recent price of $12.08, which aligns with an average target price of $14.50 per share. Meanwhile, analysts expect MASI to reach a target price of $199.28 per share, translating to a 19.68% increase from its recent price of $166.52. The chart below illustrates the 12-month price histories of OLLI, TFSL, and MASI:

A summary table detailing the current analyst target prices for these stocks is provided below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell 1000 Value ETF | IWD | $184.67 | $218.04 | 18.07% |

| Ollie’s Bargain Outlet Holdings Inc | OLLI | $101.08 | $122.13 | 20.83% |

| TFS Financial Corp | TFSL | $12.08 | $14.50 | 20.03% |

| Masimo Corp. | MASI | $166.52 | $199.28 | 19.68% |

As we consider these analyst target prices, it raises important questions: Are analysts overly optimistic about future trading values for these stocks? Do their projections reflect recent industry changes, or are they lagging behind market developments? While an elevated target can suggest optimism, it may also indicate the risk of downgrades if expectations prove unfounded. Investors should conduct further research to gauge the validity of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Healthcare Stocks Hedge Funds Are Selling

• Funds Holding BCI

• KSMT Market Cap History

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.