Analysts See Significant Upside for iShares Semiconductor ETF and Key Holdings

In a recent analysis, ETF Channel examined the underlying assets of various ETFs, including the iShares Semiconductor ETF (Symbol: SOXX). Analysts have calculated that the weighted average target price for SOXX stands at $267.38 per unit.

Current Trading Price and Analyst Projections

Currently, SOXX is trading at approximately $223.11 per unit. This suggests that analysts anticipate an upside of 19.84% based on their 12-month projections for the ETF’s underlying holdings. Key stocks contributing to this optimism include ASE Technology Holding Co Ltd (Symbol: ASX), Microchip Technology Inc (Symbol: MCHP), and Applied Materials, Inc. (Symbol: AMAT). Each has significant projected gains relative to their current trading prices.

Individual Stock Analysis

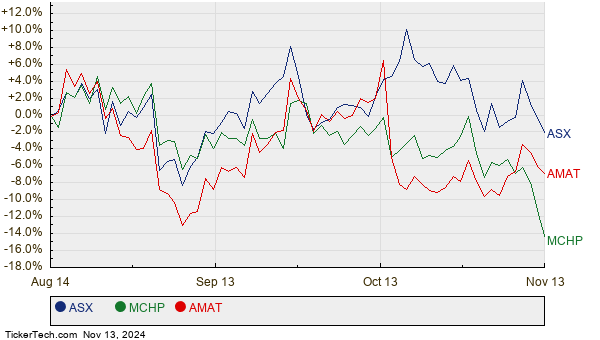

ASE Technology Holding Co Ltd (ASX) recently traded at $9.51 per share, while the average analyst target is $13.05, indicating a potential upside of 37.22%. For Microchip Technology Inc (MCHP), the current price of $67.29 represents an anticipated 27.06% increase, with an average target of $85.50. Applied Materials, Inc. (AMAT) is trading at $186.58, yet analysts project a target of $234.13, suggesting a 25.49% upside. Below is a comparative price history chart highlighting the stock performance of these three companies:

Collectively, ASX, MCHP, and AMAT constitute 7.99% of the iShares Semiconductor ETF. Below is a table summarizing the analysts’ current target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Semiconductor ETF | SOXX | $223.11 | $267.38 | 19.84% |

| ASE Technology Holding Co Ltd | ASX | $9.51 | $13.05 | 37.22% |

| Microchip Technology Inc | MCHP | $67.29 | $85.50 | 27.06% |

| Applied Materials, Inc. | AMAT | $186.58 | $234.13 | 25.49% |

Evaluating Analyst Predictions

Are these analysts’ targets realistic, or could they be overly optimistic about future stock prices? Investors should ponder whether the analysts have sound reasoning for their predictions, or if they might be outdated in light of recent developments in the industry. A higher target price in relation to a stock’s current value often reflects optimism but could also signal a risk of downgrades if the forecasts are not aligned with current market conditions. It is crucial for investors to conduct thorough research before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Waste Management Dividend Stocks

• PFS Insider Buying

• PRU Technical Analysis

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.