Analysts Predict Significant Upside for FNX and Key Holdings

In an analysis of the ETFs monitored by ETF Channel, we have evaluated the current trading prices of the underlying holdings against the average analyst’s 12-month target prices. This allowed us to calculate the weighted average implied analyst target price for the ETF itself. For the First Trust Mid Cap Core AlphaDEX Fund ETF (Symbol: FNX), this implied target price stands at $136.02 per unit.

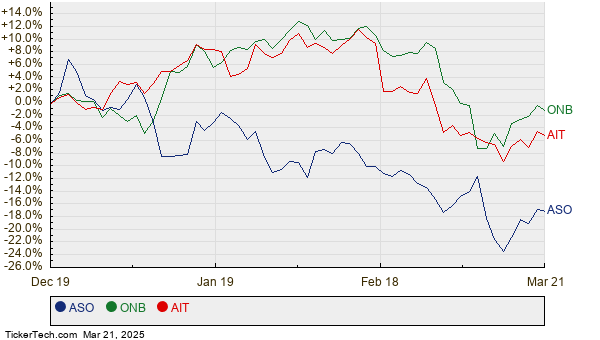

Currently, FNX is trading at approximately $109.67 per unit. This indicates a potential upside of 24.02% based on the analysts’ average targets for the underlying holdings. Noteworthy among FNX’s holdings with substantial upside potential are Academy Sports & Outdoors Inc (Symbol: ASO), Old National Bancorp (Symbol: ONB), and Applied Industrial Technologies, Inc. (Symbol: AIT). ASO’s recent trading price is $47.42 per share, while the average analyst target price is 31.52% above at $62.37 per share. ONB shows a potential upside of 28.16% from its recent price of $21.37 based on an average target of $27.39 per share. Additionally, AIT has an impressive target of $291.43 per share, representing a 27.56% increase from its current price of $228.46. Below is a chart illustrating the twelve-month price history comparing the performance of ASO, ONB, and AIT:

Below is a summary table highlighting the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Mid Cap Core AlphaDEX Fund ETF | FNX | $109.67 | $136.02 | 24.02% |

| Academy Sports & Outdoors Inc | ASO | $47.42 | $62.37 | 31.52% |

| Old National Bancorp | ONB | $21.37 | $27.39 | 28.16% |

| Applied Industrial Technologies, Inc. | AIT | $228.46 | $291.43 | 27.56% |

This leads us to question whether these analyst targets are justified or overly optimistic regarding future trading prices in the next twelve months. It is important to consider whether analysts have sound reasoning behind their projections or if they have overlooked recent changes in company performance and industry trends. A higher target price relative to a stock’s current trading price can suggest optimism, but it may also indicate a need for price target adjustments if predictions are based on outdated evaluations. Investors should conduct further research to assess these dynamics.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Cheap Shares To Watch

• HUM MACD

• Top Ten Hedge Funds Holding VGII

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.