Analyst Price Targets Suggest Strong Potential for ESML ETF

In our analysis of ETFs covered by ETF Channel, we compared the trading prices of the underlying holdings against their average analyst 12-month forward target prices. This allowed us to calculate a weighted average implied target price for the ETF itself. For the iShares ESG Aware MSCI USA Small-Cap ETF (Symbol: ESML), the implied analyst target price based on its holdings is $50.89 per unit.

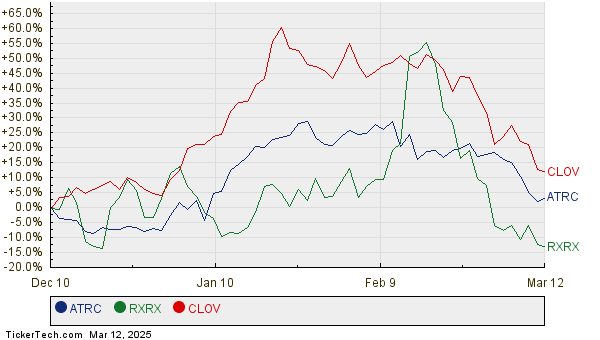

Currently, ESML is trading around $38.48 per unit, indicating that analysts see a potential upside of 32.25% based on the average targets for its underlying holdings. Notably, three of ESML’s holdings show significant upside potential compared to their analyst target prices: AtriCure Inc (Symbol: ATRC), Recursion Pharmaceuticals Inc (Symbol: RXRX), and Clover Health Investments Corp (Symbol: CLOV). ATRC, trading at a recent price of $33.94 per share, has an average analyst target that is 53.23% higher at $52.00 per share. Similarly, RXRX has a current price of $6.06, suggesting 48.51% upside if the average target of $9.00 per share is achieved. Analysts also anticipate CLOV to reach a target price of $4.75 per share, which would be an increase of 41.37% from its recent price of $3.36. Below, you can find a twelve-month price history chart comparing the stock performance of ATRC, RXRX, and CLOV:

Here’s a summary table highlighting current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares ESG Aware MSCI USA Small-Cap ETF | ESML | $38.48 | $50.89 | 32.25% |

| AtriCure Inc | ATRC | $33.94 | $52.00 | 53.23% |

| Recursion Pharmaceuticals Inc | RXRX | $6.06 | $9.00 | 48.51% |

| Clover Health Investments Corp | CLOV | $3.36 | $4.75 | 41.37% |

Questions remain regarding the validity of these analyst targets. Are analysts overly optimistic about future valuations, or do their predictions reflect a thorough understanding of recent developments within these companies and their industries? A high target price relative to a stock’s trading price may indicate optimism, but could also signal potential downgrades if those targets are based on outdated information. Investors should conduct further research into these stocks before making decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

Institutional Holders of FORK

ALT Average Annual Return

ALVR Historical Stock Prices

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.