DigitalOcean’s Outlook and Performance

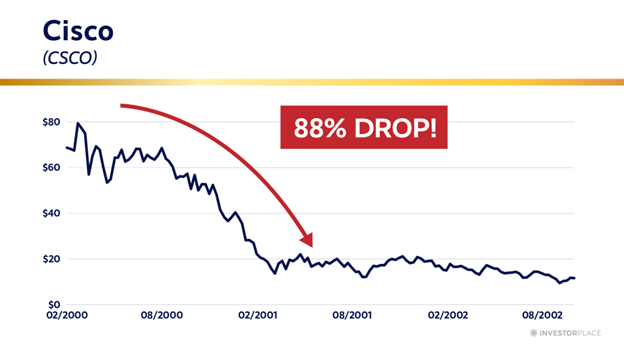

DigitalOcean (NYSE: DOCN), a cloud computing service provider catering to small and medium-sized businesses (SMBs), is currently trading at 76% below its previous peak. Despite this downturn, Wall Street analysts project a positive outlook, with a consensus price target of $41.60, indicating a potential increase of approximately 32% from current levels.

In the second quarter, DigitalOcean reported a 14% year-over-year increase in sales to an annualized $876 million, benefiting from strong demand for its user-friendly cloud services and new AI features. The company’s free cash flow also grew to $57 million, representing 26% of its revenue. While DigitalOcean has $1.5 billion in debt, it has successfully refinanced with zero-interest notes, indicating robust financial management.

Out of 13 investment analysts covering DigitalOcean, eight have recommended a buy, suggesting confidence in the stock despite a competitive cloud services market. The current valuation stands at approximately 15.2 times the expected earnings for 2025.