Analysts See Upside in SPDR Russell 1000 Yield Focus ETF

At ETF Channel, our analysis of the ETF landscape includes assessing the underlying holdings of various funds. By comparing the trading prices of individual stocks to their average 12-month analyst target prices, we have calculated the weighted average implied analyst target price for the SPDR Russell 1000 Yield Focus ETF (Symbol: ONEY). The findings indicate an implied target price of $123.59 per unit for ONEY.

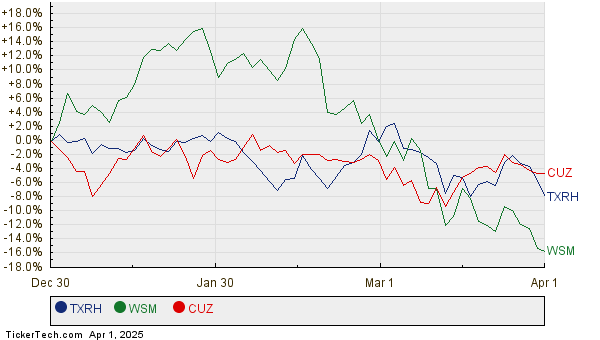

Currently trading at approximately $109.26 per unit, the ETF presents analysts with a 13.12% potential upside based on the average targets of its underlying holdings. Among these stocks, Texas Roadhouse Inc (Symbol: TXRH), Williams Sonoma Inc (Symbol: WSM), and Cousins Properties Inc (Symbol: CUZ) stand out due to their significant upside potential relative to their analyst target prices. For instance, Texas Roadhouse is priced at $166.60 per share, but analysts expect it to reach an average target price of $194.43, suggesting a potential increase of 16.71%. Similarly, Williams Sonoma trades at $158.10, with an anticipated target of $180.06, indicating a 13.89% upside. Cousins Properties, priced at $29.50, has an expected target of $33.55, translating to a 13.71% increase.

Below is a chart illustrating the 12-month price performance of TXRH, WSM, and CUZ:

Additionally, the following table summarizes the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Russell 1000 Yield Focus ETF | ONEY | $109.26 | $123.59 | 13.12% |

| Texas Roadhouse Inc | TXRH | $166.60 | $194.43 | 16.71% |

| Williams Sonoma Inc | WSM | $158.10 | $180.06 | 13.89% |

| Cousins Properties Inc | CUZ | $29.50 | $33.55 | 13.71% |

This raises important questions: Are analysts accurately predicting these targets, or are they being over-optimistic about the future stock prices? Understanding the basis for these forecasts is crucial, as high targets compared to current trading prices could either indicate strong future potential or become burdensome if market realities require downward adjustments. Investors should conduct thorough research to navigate these uncertainties.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• FJP YTD Return

• LEI Split History

• BHST Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.