iShares MSCI KLD 400 Social ETF Analysts Predict 14.16% Growth

Analyzing the iShares MSCI KLD 400 Social ETF (Symbol: DSI), our review indicates that analysts foresee significant growth ahead. The implied target price for DSI stands at $127.32 per unit based on its underlying holdings.

Current Trading Position and Upside Potential

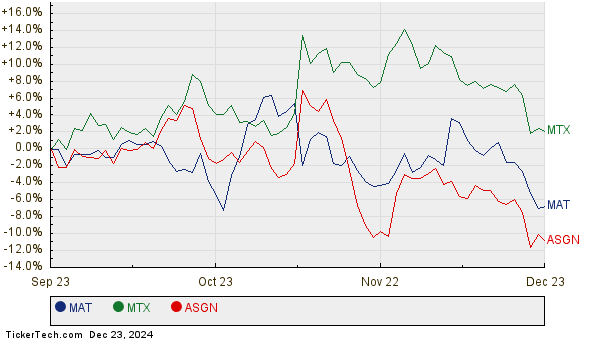

Currently, DSI is trading at around $111.52 per unit. This leaves room for a 14.16% increase, based on analysts’ forecasts for the ETF’s holdings. Some of these holdings, such as Mattel Inc (Symbol: MAT), Minerals Technologies, Inc. (Symbol: MTX), and ASGN Inc (Symbol: ASGN), exhibit particularly strong upside potential. For example, Mattel has a recent trading price of $17.86, while analysts have set an average target at $23.82, representing a notable 33.36% upside. Similarly, Minerals Technologies is priced at $75.62, with an average target of $96.50, equating to a 27.61% upside. Lastly, ASGN, trading at $83.87, has an average target of $97.83, reflecting a possible increase of 16.65%. Below is a chart illustrating the historical price movements of these stocks:

Summary of Analyst Targets

The following table summarizes the key details regarding the recent price and analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares MSCI KLD 400 Social ETF | DSI | $111.52 | $127.32 | 14.16% |

| Mattel Inc | MAT | $17.86 | $23.82 | 33.36% |

| Minerals Technologies, Inc. | MTX | $75.62 | $96.50 | 27.61% |

| ASGN Inc | ASGN | $83.87 | $97.83 | 16.65% |

Addressing Analysts’ Outlook

This begs the question: are analyst targets realistic or overly ambitious? It’s wise for investors to consider whether these estimates are based on current data and market developments. While high price targets may indicate positive future expectations, they can also foreshadow potential downgrades if they’re not grounded in today’s reality. Investors are encouraged to conduct thorough research to understand these dynamics better.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Stocks Held By Jeremy Grantham

• TPC Insider Buying

• VCNX Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.