Analyst Targets Suggest Significant Upside for WisdomTree ETF and Holdings

ETF Channel recently assessed the underlying holdings of the ETFs we track, focusing on the trading price of each holding versus the average analyst 12-month forward target price. For the WisdomTree U.S. MidCap earnings Fund ETF (Symbol: EZM), the weighted average implied analyst target price based on its holdings is $73.89 per unit.

Currently, with EZM trading around $51.81 per unit, analysts project a substantial upside of 42.62% based on average target prices for its underlying assets. Among those assets, three stand out for their expected growth relative to their current trading prices: ADMA Biologics Inc (Symbol: ADMA), CSW Industrials Inc (Symbol: CSWI), and ICU Medical Inc (Symbol: ICUI).

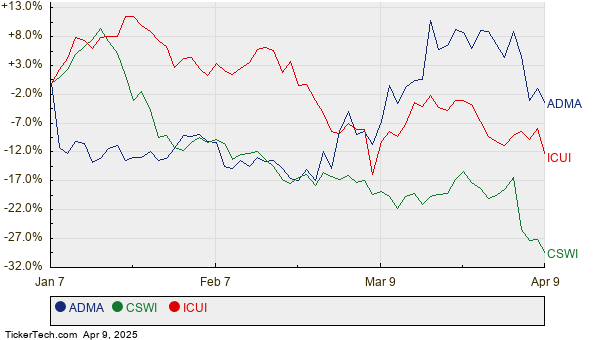

ADMA is trading at $17.86 per share, with an analyst target average suggesting a potential increase of 53.04% to $27.33 per share. CSWI, with a recent price of $254.34, holds an upside of 48.46%, as its average expected target price is $377.60 per share. Meanwhile, analysts anticipate ICUI will reach a target price of $195.33 per share, indicating a 45.80% upside from its current share price of $133.97. Below is a twelve-month price history chart presenting the performance of ADMA, CSWI, and ICUI:

Below is a summary table highlighting the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| WisdomTree U.S. MidCap earnings Fund ETF | EZM | $51.81 | $73.89 | 42.62% |

| ADMA Biologics Inc | ADMA | $17.86 | $27.33 | 53.04% |

| CSW Industrials Inc | CSWI | $254.34 | $377.60 | 48.46% |

| ICU Medical Inc | ICUI | $133.97 | $195.33 | 45.80% |

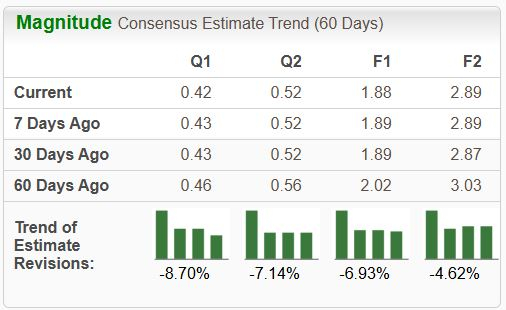

Questions arise regarding the validity of these analyst targets. Are these projections realistic, or do they reflect an overly optimistic outlook? Analysts must consider recent developments in companies and their industries to justify their expectations. A high target price relative to a stock’s current price can signal optimism but may also lead to potential downgrades if the targets are no longer relevant. These considerations merit additional research from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

Stocks Crossing Below Book Value

XIN Average Annual Return

WH YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.