Analysts Highlight Potential Upside for FCOM and Key Holdings

In a recent analysis conducted by ETF Channel, the trading prices of individual holdings within various ETFs were compared to the average 12-month forward target prices set by analysts. This led to the calculation of the weighted average implied target price for the Fidelity MSCI Communication Services Index ETF (Symbol: FCOM), which stands at $70.11 per unit.

Currently, FCOM is trading around $50.92 per unit. This suggests that industry analysts anticipate a 37.69% upside based on their average targets for the ETF’s underlying assets. Notably, three of these holdings show significant potential for growth relative to their respective analyst target prices: Magnite Inc (Symbol: MGNI), Vimeo Inc (Symbol: VMEO), and Liberty Global Ltd (Symbol: LBTYK). For instance, MGNI, which is trading at $9.07/share, has an analyst target that is 125.05% higher at $20.42/share. Similarly, VMEO, priced at $4.74, shows a potential upside of 68.78% with a target price of $8.00/share. Meanwhile, analysts expect LBTYK to reach a target of $16.00/share, representing a 49.53% increase from its current price of $10.70.

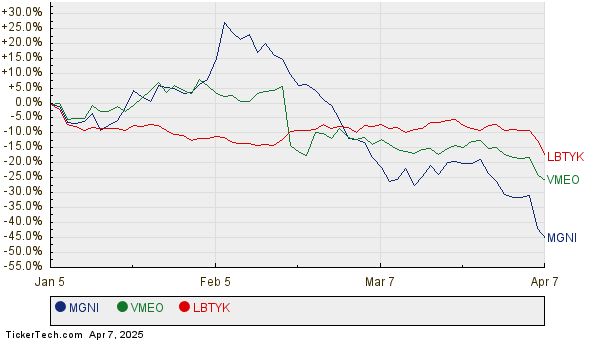

Below is a twelve-month price history chart comparing the performance of MGNI, VMEO, and LBTYK:

Here’s a summary table of the current analyst target prices highlighted earlier:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Communication Services Index ETF | FCOM | $50.92 | $70.11 | 37.69% |

| Magnite Inc | MGNI | $9.07 | $20.42 | 125.05% |

| Vimeo Inc | VMEO | $4.74 | $8.00 | 68.78% |

| Liberty Global Ltd | LBTYK | $10.70 | $16.00 | 49.53% |

The question arises: are analysts justified in these target prices, or are they overly optimistic about where these stocks will be trading in the next year? A high target price compared to a stock’s trading price may indicate optimism regarding future performance. Conversely, it might also signal potential downgrades if those targets are based on outdated information. These crucial inquiries warrant further research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

Stocks Analysts Like And Hedge Funds Are Buying

USBI Historical Stock Prices

MCO Price Target

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.