Fidelity Enhanced Large Cap Value ETF Shows Strong Analyst Upside Potential

At ETF Channel, we analyzed the underlying holdings of various ETFs and compared their trading prices against average analyst 12-month forward target prices. This review focused on the Fidelity Enhanced Large Cap Value ETF (Symbol: FELV), where we calculated an implied analyst target price of $35.75 per unit based on its underlying assets.

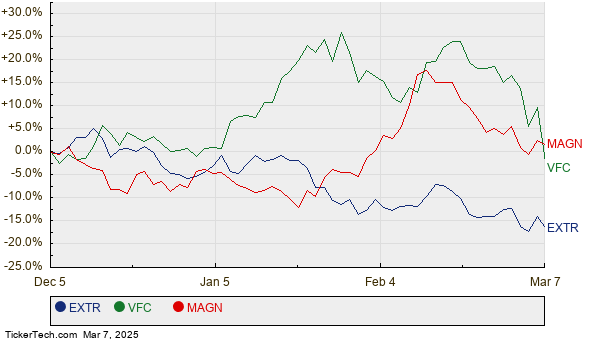

Currently, FELV is trading at approximately $30.78 per unit. This pricing suggests a potential upside of 16.16%, aligning with the average analyst targets of its underlying holdings. Three notable holdings within FELV, each with considerable upside potential, are Extreme Networks Inc (Symbol: EXTR), VF Corp. (Symbol: VFC), and Magnera Corp (Symbol: MAGN). EXTR, priced recently at $14.66 per share, has an average analyst target price of $19.80 per share, indicating an expected increase of 35.06%. Similarly, VFC shows 24.41% upside potential from its recent share price of $20.56, if it achieves the target of $25.58 per share. Lastly, MAGN’s average target of $24.00 per share is 21.09% above its current price of $19.82.

Below is a chart illustrating the twelve-month price history of EXTR, VFC, and MAGN:

Here’s a summary table of the current analyst target prices for the discussed securities:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity Enhanced Large Cap Value ETF | FELV | $30.78 | $35.75 | 16.16% |

| Extreme Networks Inc | EXTR | $14.66 | $19.80 | 35.06% |

| VF Corp. | VFC | $20.56 | $25.58 | 24.41% |

| Magnera Corp | MAGN | $19.82 | $24.00 | 21.09% |

This raises questions: Are analysts’ targets justified, or are they overly optimistic regarding these stocks’ future trading levels? It’s crucial to assess whether recent company and industry developments have been adequately evaluated by analysts. While a high price target may indicate optimism, it can also signal potential downgrades if those targets are outdated. Investors should conduct further research to draw informed conclusions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Funds Holding HAIA

• Institutional Holders of CSP

• YMAB Next earnings Date

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.