Fidelity’s FSTA ETF Shows Strong Analyst Upside Potential

At ETF Channel, we’ve analyzed the underlying assets of the ETFs we cover. We compared each holding’s trading price to the average analyst’s 12-month forward target price to calculate the weighted average implied target for the ETF. For the Fidelity MSCI Consumer Staples Index ETF (Symbol: FSTA), the implied analyst target price is $56.34 per unit.

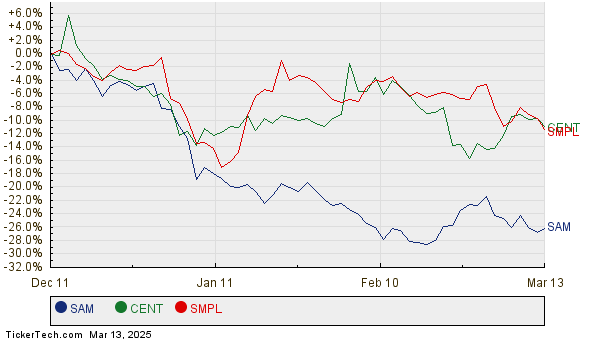

Currently, FSTA is trading at approximately $49.97 per unit, indicating a projected 12.74% upside according to the average analyst targets of its underlying holdings. Notably, three holdings in FSTA exhibit considerable potential for appreciation: Boston Beer Co Inc (Symbol: SAM), Central Garden & Pet Co (Symbol: CENT), and Simply Good Foods Company (Symbol: SMPL). SAM, with a recent trading price of $233.00 per share, has an analyst target of $279.25, suggesting a upside of 19.85%. Similarly, CENT’s recent price of $36.25 implies a 16.41% upside towards its average target of $42.20 per share. Analysts expect SMPL to reach a target of $40.44, which is 15.31% higher than its recent price of $35.08. Below is a chart depicting the twelve-month price history for SAM, CENT, and SMPL:

Here’s a summary table of the analyst target prices mentioned:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Consumer Staples Index ETF | FSTA | $49.97 | $56.34 | 12.74% |

| Boston Beer Co Inc | SAM | $233.00 | $279.25 | 19.85% |

| Central Garden & Pet Co | CENT | $36.25 | $42.20 | 16.41% |

| Simply Good Foods Company | SMPL | $35.08 | $40.44 | 15.31% |

Analysts’ target price predictions raise questions about their accuracy. Are these targets reasonable, or do they reflect excessive optimism regarding where these stocks will be trading in 12 months? Evaluating whether analysts are justifiably optimistic or lagging behind recent developments is crucial. A high price target relative to a stock’s current trading price might indicate a positive outlook but could also lead to potential downgrades if the targets are outdated. Investors are encouraged to conduct deeper research for informed decision-making.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

● Funds Holding LSEQ

● Institutional Holders of JHID

● LAZY Videos

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.