Analysts See Room for Growth in Direxion HCM Tactical Enhanced US ETF

We evaluated the underlying holdings of the funds tracked by ETF Channel to assess their potential growth. For the Direxion HCM Tactical Enhanced US ETF (Symbol: HCMT), analysts have set an average target price of $41.13 per unit, indicating upside potential based on current trading prices.

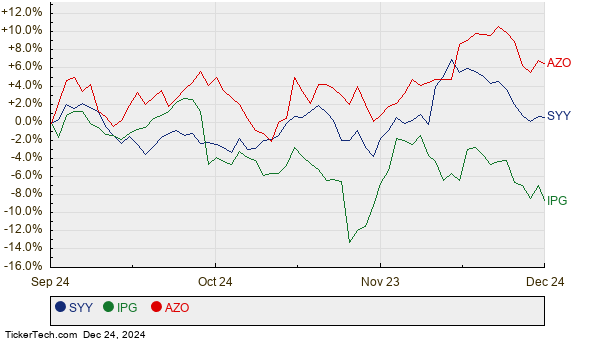

Currently priced at approximately $37.51 per unit, HCMT shows a potential increase of 9.65%. Looking deeper, key holdings contributing to this outlook include Sysco Corp (Symbol: SYY), Interpublic Group of Companies Inc. (Symbol: IPG), and AutoZone, Inc. (Symbol: AZO). Specifically, Sysco Corp’s recent price stands at $76.89, yet analysts predict it could rise 11.45% to an average target of $85.69. Interpublic Group, valued at $28.50, has a target of $31.75, representing an upside of 11.40%. Meanwhile, AutoZone’s recent price of $3,242.23 has an expected rise of 11.20%, reaching a target of $3,605.35. Below, we present a twelve-month performance chart comparing SYY, IPG, and AZO:

Here is a table summarizing the current analyst target prices for the mentioned holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Direxion HCM Tactical Enhanced US ETF | HCMT | $37.51 | $41.13 | 9.65% |

| Sysco Corp | SYY | $76.89 | $85.69 | 11.45% |

| Interpublic Group of Companies Inc. | IPG | $28.50 | $31.75 | 11.40% |

| AutoZone, Inc. | AZO | $3,242.23 | $3,605.35 | 11.20% |

As investors consider these target prices, they must ask: are analysts being realistic, or are their expectations overly ambitious? Also, do analysts have adequate reasoning for their targets, or are they lagging behind the latest trends? High price targets could signal optimism about future performance, but they can also lead to adjustments downward if seen as outdated. Such considerations call for thorough investigation by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ALF market cap history

• RG Split History

• Institutional Holders of FIGB

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.