Analysts Project Growth for ProShares NOBL ETF and Top Holdings

In our latest review of ETFs, ETF Channel analyzed the underlying holdings of the ProShares S&P 500 Dividend Aristocrats ETF (Symbol: NOBL). We compared the trading prices of these holdings against the average analyst’s 12-month forward target price. This analysis revealed that the weighted average implied analyst target price for NOBL stands at $110.63 per unit.

Currently, NOBL is trading at approximately $99.94 per unit. This indicates a potential upside of 10.69% according to analysts, based on the average targets for its underlying holdings. Among those holdings, three companies stand out with significant upside: Smith (A O) Corp (Symbol: AOS), Cardinal Health, Inc. (Symbol: CAH), and Franklin Resources Inc (Symbol: BEN).

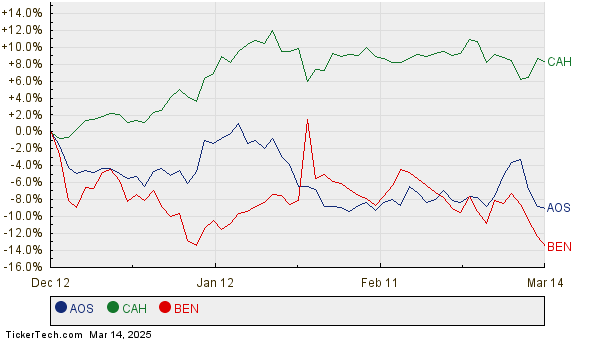

AOS is presently priced at $65.45 per share, while the average analyst target is 13.91% higher at $74.56 per share. Similarly, Cardinal Health shows a 12.61% upside potential from its recent share price of $126.27, with an average target of $142.19 per share. Analysts also project Franklin Resources to reach a target price of $21.12 per share, reflecting an 11.65% increase over its current price of $18.92. Below is a twelve-month performance chart for AOS, CAH, and BEN:

Here is a summary table of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| ProShares S&P 500 Dividend Aristocrats ETF | NOBL | $99.94 | $110.63 | 10.69% |

| Smith (A O) Corp | AOS | $65.45 | $74.56 | 13.91% |

| Cardinal Health, Inc. | CAH | $126.27 | $142.19 | 12.61% |

| Franklin Resources Inc | BEN | $18.92 | $21.12 | 11.65% |

This raises questions about the validity of these targets. Are analysts justified in their projections, or are they overly optimistic about future trading conditions? Further analysis and research into recent company and industry developments will be essential in determining whether these target prices are realistic.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also See:

• Top Stocks Held By Barry Rosenstein

• GNLX Stock Predictions

• NHTC Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.