Analyst Target Upside for SPDR Russell 1000 Yield Focus ETF

At ETF Channel, we have analyzed the underlying holdings of various ETFs. We compared the trading prices of each holding to the average analyst 12-month forward target prices, allowing us to compute a weighted average implied analyst target price for the ETFs themselves. For the SPDR Russell 1000 Yield Focus ETF (Symbol: ONEY), the implied analyst target price based on its underlying holdings is $124.42 per unit.

Currently, ONEY is trading at approximately $108.52 per unit. This indicates that analysts see a potential upside of 14.65% for this ETF, based on the average target prices of the underlying holdings. Notable upside candidates among ONEY’s holdings include Cullen/Frost Bankers, Inc. (Symbol: CFR), SLM Corp. (Symbol: SLM), and First Hawaiian Inc. (Symbol: FHB).

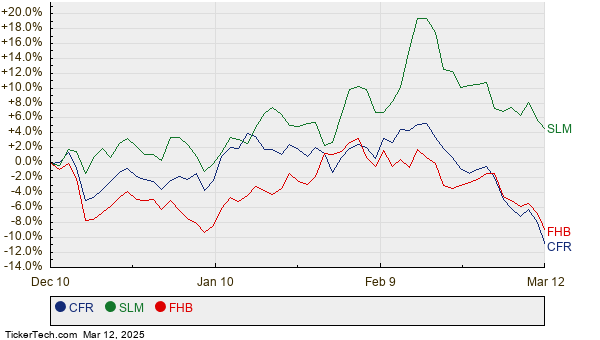

CFR has a recent trading price of $121.84 per share, with an average analyst target of $143.50 per share, reflecting a potential upside of 17.78%. SLM shares are currently priced at $28.45, suggesting a 16.95% upside as analysts target $33.27 per share. Similarly, FHB is trading at $24.70, with analysts expecting a rise to a target price of $28.75 per share, indicating an upside of 16.40%. Below is a twelve-month price history chart comparing the stock performance of CFR, SLM, and FHB:

Summary of Analyst Target Prices

The table below summarizes the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Russell 1000 Yield Focus ETF | ONEY | $108.52 | $124.42 | 14.65% |

| Cullen/Frost Bankers, Inc. | CFR | $121.84 | $143.50 | 17.78% |

| SLM Corp. | SLM | $28.45 | $33.27 | 16.95% |

| First Hawaiian Inc | FHB | $24.70 | $28.75 | 16.40% |

Are analysts justified in these targets, or are they overly optimistic about where these stocks will trade in the next 12 months? Examining whether analysts have valid reasons for their targets or if they are lagging behind recent developments in these companies and their industries is crucial. A high target price relative to a stock’s trading price can reflect optimism, but it might also precede price target downgrades if the targets are outdated. These are essential questions requiring further investor research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Institutional Holders of IGRO

Funds Holding TLYS

MMC RSI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.