Analysts Predict Upside Potential for Columbia Research Enhanced Core ETF (RECS)

Investment analysts have identified significant upside potential for the Columbia Research Enhanced Core ETF (Symbol: RECS), suggesting a price increase based on their target valuations of its underlying assets.

Upon reviewing the current trading performance, RECS is priced around $35.88 per unit. With an estimated target price of $39.80, analysts forecast a potential increase of 10.93%. Three major holdings in RECS stand out for their predicted growth: Columbia Banking System Inc (Symbol: COLB), Flowserve Corp (Symbol: FLS), and Gaming & Leisure Properties, Inc (Symbol: GLPI).

Columbia Banking System Inc shares recently traded at $28.63 while the average target price stands at $31.91, indicating an upside of 11.45%. Flowserve Corp is trading at $59.83, with an expected target price of $66.60, representing an anticipated increase of 11.32%. Additionally, Gaming & Leisure Properties, Inc shows a potential rise of 11.08% from a current price of $48.99 to a target of $54.42.

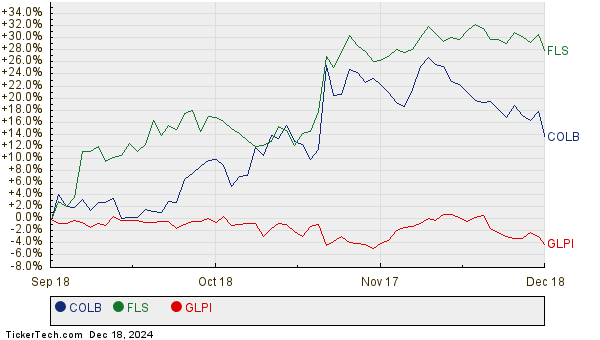

Below is a twelve-month price history chart comparing the performance of COLB, FLS, and GLPI:

Here’s a summary table of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Columbia Research Enhanced Core ETF | RECS | $35.88 | $39.80 | 10.93% |

| Columbia Banking System Inc | COLB | $28.63 | $31.91 | 11.45% |

| Flowserve Corp | FLS | $59.83 | $66.60 | 11.32% |

| Gaming & Leisure Properties, Inc | GLPI | $48.99 | $54.42 | 11.08% |

Are analysts setting realistic expectations, or are they being overly optimistic about future prices? This prompts investors to investigate if these targets hold merit or merely reflect outdated views on the market.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding MEDS

• Top Ten Hedge Funds Holding AVDV

• INOV YTD Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.