SPDR Portfolio S&P 500 Growth ETF Analyst Targets Show Upside Potential

ETF Channel has analyzed the SPDR Portfolio S&P 500 Growth ETF (Symbol: SPYG) by comparing its holdings’ trading prices to the average analyst 12-month target prices. The implied analyst target price for SPYG is $99.14 per unit based on its underlying holdings.

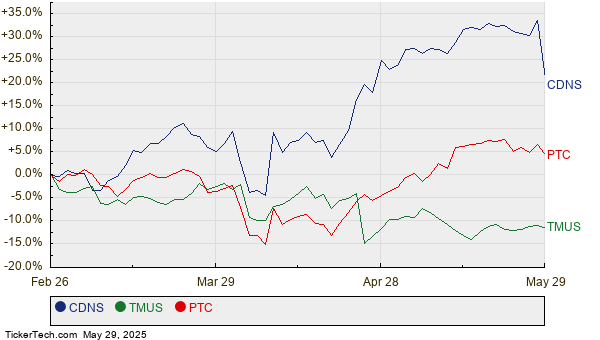

Currently, SPYG trades at approximately $89.56 per unit, indicating a potential upside of 10.70% according to analysts. Notably, three underlying holdings show significant upside to their analyst target prices: Cadence Design Systems Inc (Symbol: CDNS), T-Mobile US Inc (Symbol: TMUS), and PTC Inc (Symbol: PTC). CDNS, trading at $288.61, has an average target of $326.17, suggesting a 13.01% upside. TMUS’s recent price of $241.51 indicates a 12.02% upside to its target of $270.53. Meanwhile, PTC, priced at $167.38, has a target of $186.39, reflecting an 11.36% upside. Below is a twelve-month price history chart comparing the performance of these stocks:

The following table summarizes the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 500 Growth ETF | SPYG | $89.56 | $99.14 | 10.70% |

| Cadence Design Systems Inc | CDNS | $288.61 | $326.17 | 13.01% |

| T-Mobile US Inc | TMUS | $241.51 | $270.53 | 12.02% |

| PTC Inc | PTC | $167.38 | $186.39 | 11.36% |

Investors should consider whether analysts’ price targets are justified or overly optimistic. A higher target relative to a stock’s trading price may indicate future potential but could also lead to downgrades if past conditions no longer apply. Further research is recommended for investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Funds Holding VLON

ATLC Average Annual Return

HEES Dividend History

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.