Analysts See Potential Growth for Day Hagan/Ned Davis Smart Sector ETF

In a recent evaluation of exchange-traded funds (ETFs), ETF Channel analyzed the underlying holdings of the Day Hagan/Ned Davis Research Smart Sector ETF (Symbol: SSUS). The findings reveal an implied analyst target price of $47.10 per unit, indicating potential for growth.

Current Trading Insights

Currently, SSUS is trading at approximately $42.20 per unit. This suggests an 11.62% upside based on the average target prices from analysts reviewing the ETF’s holdings. Among the notable holdings with significant potential are The Materials Select Sector SPDR Fund (Symbol: XLE), The Utilities Select Sector SPDR Fund (Symbol: XLU), and iShares Trust – Core S&P 500 Exchange Traded Fund (Symbol: IVV). XLE, currently at $84.55/share, is projected to rise by 23.32% to an average target of $104.27/share. Similarly, XLU’s recent price of $75.76 carries a potential 14.03% gain toward its target of $86.39/share. Meanwhile, IVV, trading at $591.07/share, has an average target of $667.22/share, signaling a possible upside of 12.88%.

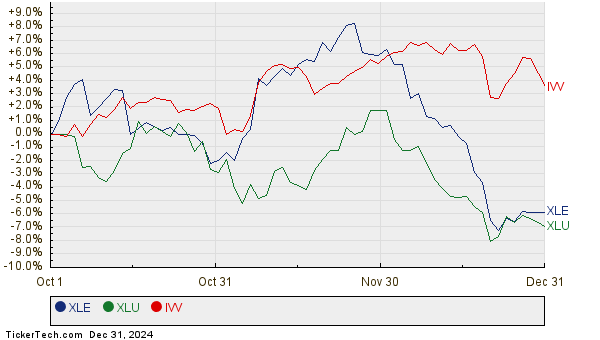

Performance Comparison

Below is a price history chart that shows the performance of XLE, XLU, and IVV over the past twelve months:

Investment Breakdown

XLE, XLU, and IVV make up 29.22% of the Day Hagan/Ned Davis Research Smart Sector ETF. Here’s a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Day Hagan/Ned Davis Research Smart Sector ETF | SSUS | $42.20 | $47.10 | 11.62% |

| The Materials Select Sector SPDR Fund | XLE | $84.55 | $104.27 | 23.32% |

| The Utilities Select Sector SPDR Fund | XLU | $75.76 | $86.39 | 14.03% |

| iShares Trust – Core S&P 500 Exchange Traded Fund | IVV | $591.07 | $667.22 | 12.88% |

Market Perspective

These target prices raise questions about whether analysts are being realistic in their forecasts or if they are too optimistic based on past performance. High price targets can show confidence in future growth, but they may also indicate that targets need adjustment if they do not reflect recent developments in companies or industries. Investors will need to conduct further research to evaluate the validity of these expected outcomes.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Ten Hedge Funds Holding HYXU

• MHK market cap history

• XLU shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.