Analysts See Potential Gains for iShares MSCI USA Min Vol ETF

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage. We compared the trading price of each holding against the average analyst’s 12-month forward target price and calculated the weighted average implied target price for the ETF. For the iShares MSCI USA Min Vol Factor ETF (Symbol: USMV), we found that the implied analyst target price is $102.97 per unit.

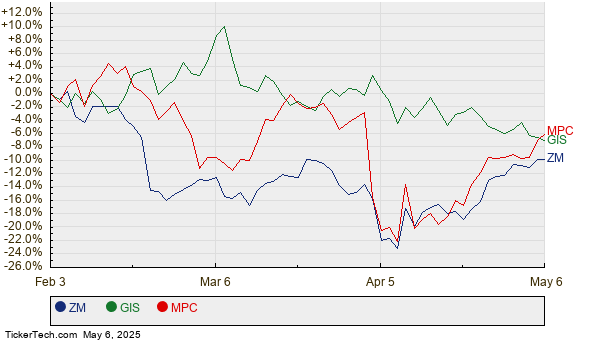

Currently, USMV is trading at approximately $92.75 per unit, suggesting analysts anticipate an 11.02% upside based on the average target prices of the ETF’s underlying holdings. Notably, three of these holdings show considerable potential for growth: Zoom Communications Inc (Symbol: ZM), General Mills Inc (Symbol: GIS), and Marathon Petroleum Corp. (Symbol: MPC). ZM, priced at $78.23 per share, has an average target price of $87.69, indicating a potential upside of 12.10%. Similarly, GIS is trading at $55.05, with a target price of $61.55, showing an 11.81% upside. Analysts expect MPC to reach a target price of $159.67, which is 11.40% above its recent price of $143.33. Below is a price history chart illustrating the stock performance of ZM, GIS, and MPC:

Here’s a summary of the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares MSCI USA Min Vol Factor ETF | USMV | $92.75 | $102.97 | 11.02% |

| Zoom Communications Inc | ZM | $78.23 | $87.69 | 12.10% |

| General Mills Inc | GIS | $55.05 | $61.55 | 11.81% |

| Marathon Petroleum Corp. | MPC | $143.33 | $159.67 | 11.40% |

Investors may wonder if analysts’ targets are justified or overly optimistic regarding these stocks’ future performance. High target prices relative to current trading prices can reflect optimism, but they may also indicate potential downgrades if the targets do not align with recent developments in the market. Further research and consideration of recent company and industry trends are essential for investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

See also:

• Top Ten Hedge Funds Holding MSD

• Funds Holding SONY

• HBM YTD Return

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.