Analysts See Upside for Vanguard Mid-Cap Value ETF and Key Holdings

At ETF Channel, we evaluated the Vanguard Mid-Cap Value ETF (Symbol: VOE) by comparing the trading prices of its underlying holdings with the average 12-month price targets set by analysts. This analysis revealed that the implied target price for VOE is $187.64 per unit.

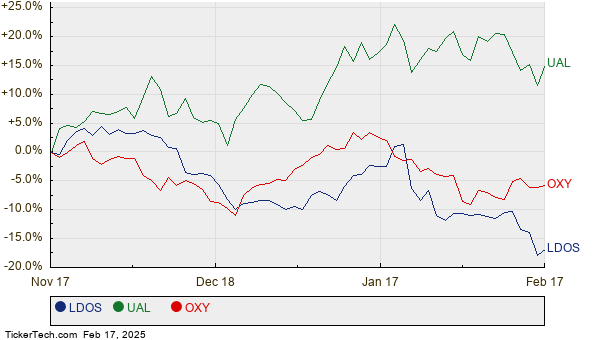

Currently, VOE is trading at approximately $164.97 per unit, suggesting that analysts predict a potential upside of 13.74% based on the performance expectations of its underlying holdings. Notably, three stocks within VOE hold significant promise for investors: Leidos Holdings Inc (Symbol: LDOS), United Airlines Holdings Inc (Symbol: UAL), and Occidental Petroleum Corp (Symbol: OXY). LDOS, priced at $132.26 per share, has an average analyst target that is 38.77% higher at $183.53. UAL is trading at $104.26, which means it could rise 29.03% to reach an average target of $134.53. Meanwhile, OXY’s shares are currently at $48.06, with a target price of $60.16 reflecting a potential upside of 25.18%. Below is a chart detailing the recent price movements of these stocks:

Highlighted below are the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Mid-Cap Value ETF | VOE | $164.97 | $187.64 | 13.74% |

| Leidos Holdings Inc | LDOS | $132.26 | $183.53 | 38.77% |

| United Airlines Holdings Inc | UAL | $104.26 | $134.53 | 29.03% |

| Occidental Petroleum Corp | OXY | $48.06 | $60.16 | 25.18% |

Are analysts justified in these optimistic targets, or could they be too hopeful about the performance of these stocks over the next year? It’s essential for investors to consider if analysts are keeping pace with the latest developments in the industries of these companies. A high target price compared to a stock’s current trading price indicates optimism, but it could also suggest a need for potential downgrades if the evaluations are outdated. These are crucial questions for investors as they conduct further research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

CLSD Videos

SYRE YTD Return

ANET Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.