Analysts Forecast Growth for Key Stocks in iShares S&P 500 Growth ETF

In a recent analysis by ETF Channel, we evaluated the underlying assets of the iShares S&P 500 Growth ETF (Symbol: IVW). Our findings revealed that the implied analyst target price for this ETF is $113.05 per unit, based on its constituent companies.

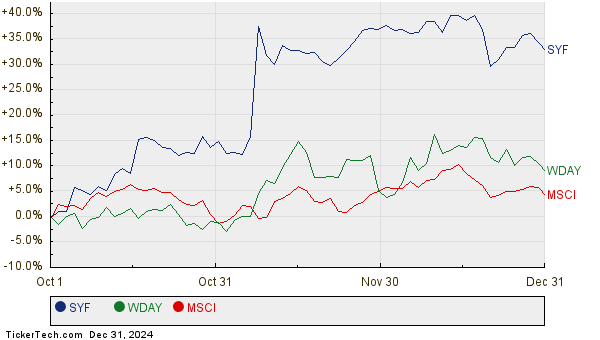

Currently, IVW is trading around $102.42 per unit, suggesting a potential upside of 10.37% according to analyst projections. Notably, three of IVW’s key holdings are expected to perform particularly well against their target prices. These are Synchrony Financial (Symbol: SYF), Workday Inc (Symbol: WDAY), and MSCI Inc (Symbol: MSCI). SYF is priced at $65.05 per share, with analysts forecasting an increase of 11.41% to a target of $72.47 per share. WDAY shows a similar projection of 11.07% upward potential, moving from a recent price of $262.00 to an expected $291.00 per share. Analysts anticipate that MSCI will reach a target price of $662.53 per share, equating to a 10.49% increase from its current trading price of $599.65. The accompanying chart illustrates the twelve-month performance history of SYF, WDAY, and MSCI:

The table below summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares S&P 500 Growth ETF | IVW | $102.42 | $113.05 | 10.37% |

| Synchrony Financial | SYF | $65.05 | $72.47 | 11.41% |

| Workday Inc | WDAY | $262.00 | $291.00 | 11.07% |

| MSCI Inc | MSCI | $599.65 | $662.53 | 10.49% |

Investors may wonder whether these analyst targets are realistic or too optimistic given recent market trends. A high target price relative to a stock’s current trading price can often indicate a bullish outlook, but it may also lead to adjustments in forecasts if market conditions change significantly. Such considerations warrant further investor investigation.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• ETFs Holding HRS

• TESS market cap history

• GDEF Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.