Analysts See Strong Upside Potential for XLI ETF Holdings

Analyzing the ETFs in our coverage, we compared the trading prices of their underlying holdings to the average 12-month analyst target prices. For the Industrial Select Sector SPDR Fund ETF (Symbol: XLI), we found that the implied analyst target price based on its holdings is $146.91 per unit.

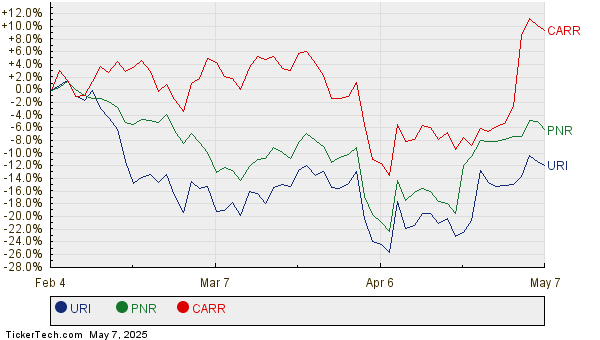

XLI is currently trading at around $133.47 per unit, suggesting a potential upside of 10.07% according to analyst projections for the underlying holdings. Notable holdings contributing to this upside include United Rentals Inc (Symbol: URI), Pentair PLC (Symbol: PNR), and Carrier Global Corp (Symbol: CARR). URI’s recent trading price is $651.65 per share, while the average analyst target is $722.59, indicating an upside of 10.89%. Similarly, PNR’s recent share price is $91.58, with a target price of $101.17, showing 10.47% potential upside. Lastly, analysts expect CARR to reach $77.53, which represents a 10.45% increase over its recent price of $70.19. Below is a twelve-month price history chart comparing the stock performance of URI, PNR, and CARR:

Below is a summary table of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| The Industrial Select Sector SPDR Fund ETF | XLI | $133.47 | $146.91 | 10.07% |

| United Rentals Inc | URI | $651.65 | $722.59 | 10.89% |

| Pentair PLC | PNR | $91.58 | $101.17 | 10.47% |

| Carrier Global Corp | CARR | $70.19 | $77.53 | 10.45% |

Are analysts justified in these targets, or are they overly optimistic regarding these stocks’ future performance? Understanding whether their expectations are supported by recent company and industry developments is crucial for investors. A high target relative to a stock’s trading price may indicate optimism but could also signal potential downgrades if those targets no longer reflect current realities. Investors should conduct further research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Intercontinental Exchange Technical Analysis

• MPWR Dividend Growth Rate

• Institutional Holders of AF

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.