Columbia Research Enhanced Core ETF Analysts Target Implies 10.75% Upside

At ETF Channel, we’ve analyzed the underlying holdings of various ETFs in our coverage universe. By comparing each holding’s current trading price against the average analyst’s 12-month forward target price, we calculated the weighted average implied target price for the Columbia Research Enhanced Core ETF (Symbol: RECS). Our findings show the ETF’s implied target price is $39.04 per unit.

Currently, RECS is trading around $35.25 per unit. This indicates analysts predict a potential upside of 10.75% based on average targets from the ETF’s underlying holdings. Notably, three of RECS’s underlying stocks show particularly significant upside potential: Spectrum Brands Holdings Inc (Symbol: SPB), Envista Holdings Corp (Symbol: NVST), and Voya Financial Inc (Symbol: VOYA).

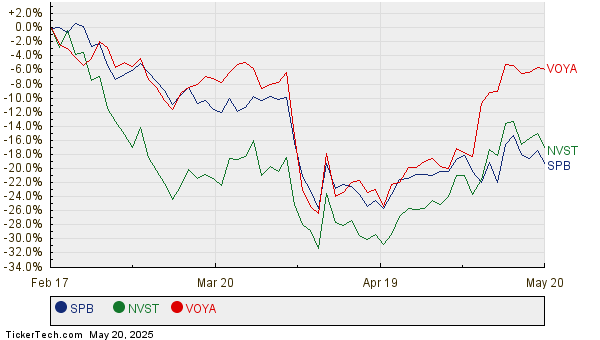

For instance, SPB is currently priced at $63.65 per share, while analysts project a target of $90.12, suggesting a considerable upside of 41.59%. Similarly, NVST, trading at $17.70, has a target price of $19.88, representing a 12.29% increase. Analysts forecast VOYA’s target to rise to $77.83, a 12.26% upside from its recent price of $69.33. Below, a 12-month price history chart shows the stock performance of SPB, NVST, and VOYA:

Here is a summary table outlining the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Columbia Research Enhanced Core ETF | RECS | $35.25 | $39.04 | 10.75% |

| Spectrum Brands Holdings Inc | SPB | $63.65 | $90.12 | 41.59% |

| Envista Holdings Corp | NVST | $17.70 | $19.88 | 12.29% |

| Voya Financial Inc | VOYA | $69.33 | $77.83 | 12.26% |

The question remains: Are analysts justified in their targets or overly optimistic about these stocks’ potential over the next 12 months? Investors should consider whether the targets reflect valid forecasts amid recent company and industry developments. Elevated price targets relative to current trading prices can symbolize optimism. However, they may also precede downgrades if the targets are outdated. Further research is warranted to evaluate these considerations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Insights:

• DWDP market cap history

• WW Stock Predictions

• MAYZ Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.