Analysts Predict Strong Growth for Vanguard Mid-Cap Growth ETF

After analyzing the ETF Channel’s coverage, we compared ETF holdings’ trading prices with average analyst target prices for the next 12 months. For the Vanguard Mid-Cap Growth ETF (Symbol: VOT), the calculated implied analyst target price stands at $289.56 per share.

Potential Upside for VOT

Currently priced at about $256.14 per unit, VOT presents an enticing upside of 13.05% based on analyst forecasts of its underlying holdings. Among these are three stocks with particularly strong upside potential: Moderna Inc (Symbol: MRNA), BioMarin Pharmaceutical Inc (Symbol: BMRN), and First Solar Inc (Symbol: FSLR). Recently, MRNA traded at $42.25 per share, yet analysts project a target of $78.18, representing a massive 85.04% increase. BMRN shows a 45.86% upside from its recent price of $67.38, with an average target of $98.28. Meanwhile, FSLR’s current price of $189.24 comes with a target of $275.43, suggesting a 45.55% upside potential.

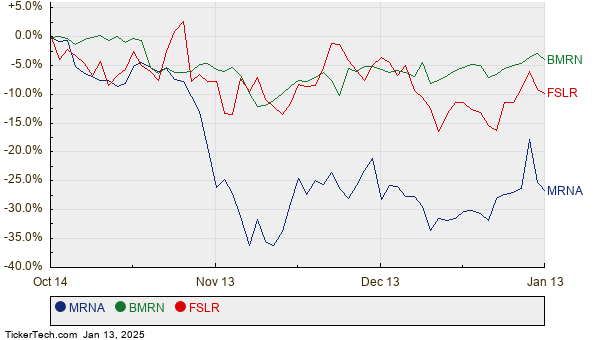

Stock Performance Overview

Below is a chart outlining the twelve-month price history for MRNA, BMRN, and FSLR:

Current Analyst Target Pricing Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Mid-Cap Growth ETF | VOT | $256.14 | $289.56 | 13.05% |

| Moderna Inc | MRNA | $42.25 | $78.18 | 85.04% |

| BioMarin Pharmaceutical Inc | BMRN | $67.38 | $98.28 | 45.86% |

| First Solar Inc | FSLR | $189.24 | $275.43 | 45.55% |

Are Analysts’ Targets Justified?

Investors may ponder whether these targets are realistic or overly ambitious. Analysts’ high price predictions can indicate positive outlooks on stock performance, but they can also foreshadow potential downgrades if based on outdated information. It would be prudent for investors to conduct further research into recent developments affecting these companies and industries.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Semiconductors Dividend Stocks

• CYBR YTD Return

• CRSA Videos

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.