Analysts Predict Potential Gains for Vanguard High Dividend Yield ETF

In our analysis at ETF Channel, we assessed the underlying assets of various ETFs, comparing their trading prices with the anticipated 12-month target prices set by analysts. For the Vanguard High Dividend Yield ETF (Symbol: VYM), the weighted average implied target price is $144.64 per unit.

Recent Trading Insights for VYM

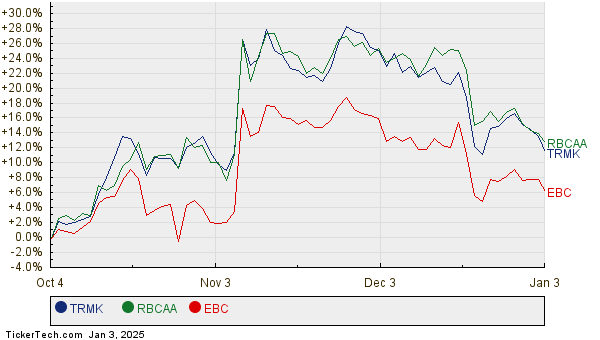

Currently trading around $127.54 per unit, VYM offers an attractive upside potential of 13.41% based on the average target prices of its underlying holdings. Among these, three positions stand out with notable upside: Trustmark Corp (Symbol: TRMK), Republic Bancorp, Inc. (Symbol: RBCAA), and Eastern Bankshares Inc (Symbol: EBC). TRMK, priced recently at $34.61 per share, has a target price 16.30% higher at $40.25. Similarly, RBCAA’s current price is $68.99, with an expected rise to $80.00 reflecting a 15.96% upside. Analysts project a target price of $19.50 for EBC, which is 15.04% above its recent price of $16.95. Below, you’ll find a chart that tracks these stocks’ performance over the past twelve months:

Current Analyst Target Price Summary

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard High Dividend Yield ETF | VYM | $127.54 | $144.64 | 13.41% |

| Trustmark Corp | TRMK | $34.61 | $40.25 | 16.30% |

| Republic Bancorp, Inc. | RBCAA | $68.99 | $80.00 | 15.96% |

| Eastern Bankshares Inc | EBC | $16.95 | $19.50 | 15.04% |

Evaluating Analyst Optimism

As investors consider these target prices, it’s crucial to question whether analysts are being optimistic or if their predictions hold water. Do these targets reflect a reasonable evaluation of recent developments in these companies and their industries? A price target significantly above the current market price might indicate optimism; however, it could also suggest that past projections are no longer relevant. Investors are encouraged to conduct their own research to explore the implications.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• Convertible Preferred Stocks

• Hologic shares outstanding history

• Institutional Holders of CMGE

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.