Analysts See Bright Future for Vanguard High Dividend Yield ETF

In a recent analysis of exchange-traded funds (ETFs), we explored the Vanguard High Dividend Yield ETF (Symbol: VYM) and compared its trading price against the average 12-month target prices set by analysts for its underlying holdings. This research indicates that VYM has an implied target price of $145.84 per unit.

Current Trading Price and Analyst Expectations

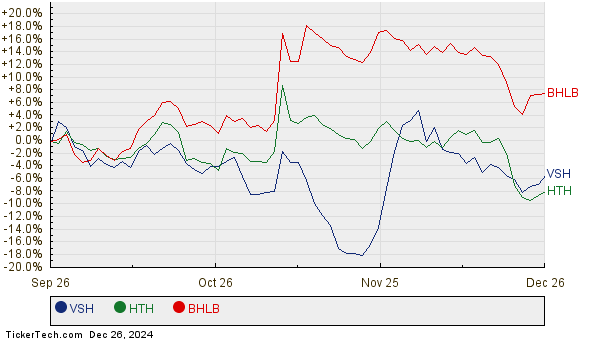

Currently, VYM is trading at approximately $128.99 per unit. Analysts project a potential upside of 13.07% based on the average targets for its underlying holdings. Some notable holdings include Vishay Intertechnology, Inc. (Symbol: VSH), Hilltop Holdings, Inc. (Symbol: HTH), and Berkshire Hills Bancorp Inc. (Symbol: BHLB). As of now, VSH is priced at $17.54 per share, but analysts expect it to reach a target of $20.33/share, a 15.92% increase. HTH shows a similar perspective: trading at $29.15 with a target of $33.67/share, suggesting a 15.49% upside. For BHLB, the recent price is $28.66, while the forecasted target is $32.83/share, representing a 14.56% rise. Below is a chart detailing the stock performance of VSH, HTH, and BHLB over the past twelve months:

Summary of Analyst Target Prices

Here is a summary of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard High Dividend Yield ETF | VYM | $128.99 | $145.84 | 13.07% |

| Vishay Intertechnology, Inc. | VSH | $17.54 | $20.33 | 15.92% |

| Hilltop Holdings, Inc. | HTH | $29.15 | $33.67 | 15.49% |

| Berkshire Hills Bancorp Inc. | BHLB | $28.66 | $32.83 | 14.56% |

Assessing Analyst Targets: Realistic or Overly Optimistic?

The question remains: Are analysts being realistic in their price targets, or are they setting expectations too high considering recent market changes? A high target relative to a stock’s current price may suggest optimism, but it could also foreshadow potential downgrades if the estimates no longer align with the current market climate. Investors should continue their research when considering these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding PULB

• Institutional Holders of HUN

• AR Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.