“`html

Analysts Predict Significant Upside for DGRO and Key Holdings

In our analysis at ETF Channel, we evaluated the underlying holdings of various ETFs. By comparing each holding’s trading price against the average analyst’s 12-month forward target price, we calculated the weighted average implied analyst target price for the iShares Core Dividend Growth ETF (Symbol: DGRO). Our findings indicate that the implied target price for DGRO is $68.72 per unit.

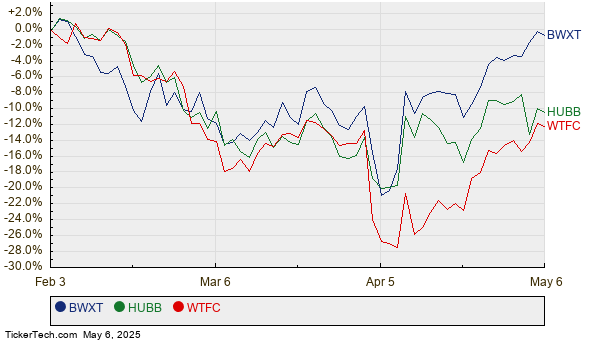

Currently, DGRO is trading at around $60.54 per unit, suggesting an upside potential of 13.51% based on the average analyst targets for its underlying holdings. Among the notable holdings with substantial upside are BWX Technologies Inc (Symbol: BWXT), Hubbell Inc. (Symbol: HUBB), and Wintrust Financial Corp (Symbol: WTFC). BWXT trades at $112.01 per share but has an average target price of $133.20, representing an upside of 18.92%. Similarly, HUBB shows a potential 17.74% increase from its current price of $353.51, with a target of $416.22. Lastly, WTFC is expected to climb to a target price of $134.58, indicating a 16.87% upside from its recent price of $115.16. Below is a twelve-month price history chart comparing the performance of BWXT, HUBB, and WTFC:

Here’s a summary table of the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Core Dividend Growth ETF | DGRO | $60.54 | $68.72 | 13.51% |

| BWX Technologies Inc | BWXT | $112.01 | $133.20 | 18.92% |

| Hubbell Inc. | HUBB | $353.51 | $416.22 | 17.74% |

| Wintrust Financial Corp | WTFC | $115.16 | $134.58 | 16.87% |

Are analysts justified in their targets, or are they overly optimistic about these stocks’ future prices? Investors should consider whether analysts have adequately accounted for recent company and industry developments. A high target price relative to a stock’s current trading price can indicate optimism. However, if expectations are not met, it may lead to target price downgrades. This warrants further investor research.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Top Dividend Stocks

• SSG Historical Prices

• VRNS Historical Prices

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`