Fidelity MSCI Real Estate ETF Shows Potential for Growth

In our latest analysis at ETF Channel, we examined the underlying holdings of various ETFs. We specifically compared the trading price of each holding against the average analyst 12-month forward target price. Through this analysis, we calculated the weighted average implied analyst target price for the Fidelity MSCI Real Estate Index ETF (Symbol: FREL), which stands at $31.16 per unit.

Currently, FREL is trading at approximately $27.41 per unit, suggesting a potential upside of 13.67% based on the average targets set by analysts for its underlying holdings. Notably, three of FREL’s holdings present significant upside potential: Apartment Investment & Management Co (Symbol: AIV), Safehold Inc (Symbol: SAFE), and Pebblebrook Hotel Trust (Symbol: PEB). For instance, AIV has a recent share price of $8.91, while its average analyst target sits at $11.50, representing a 29.07% increase. Likewise, SAFE, currently priced at $19.05, could climb 28.85% to reach its target of $24.55. Meanwhile, PEB is expected to rise to a target price of $14.00, indicating a 27.85% upside from its recent trading price of $10.95.

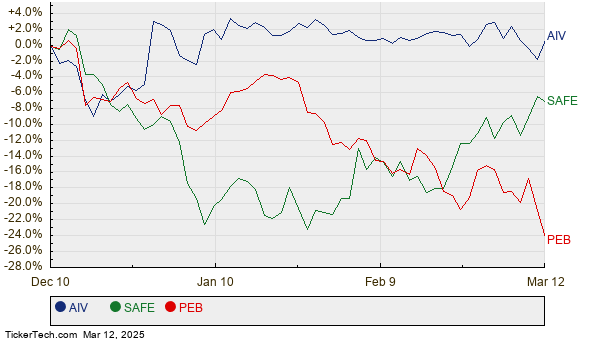

To illustrate these trends, below is a twelve-month price history chart comparing the stock performances of AIV, SAFE, and PEB:

Here is a summary of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Fidelity MSCI Real Estate Index ETF | FREL | $27.41 | $31.16 | 13.67% |

| Apartment Investment & Management Co | AIV | $8.91 | $11.50 | 29.07% |

| Safehold Inc | SAFE | $19.05 | $24.55 | 28.85% |

| Pebblebrook Hotel Trust | PEB | $10.95 | $14.00 | 27.85% |

Investors may wonder if analysts’ targets are justified or overly optimistic regarding the future trading positions of these stocks over the next 12 months. It is essential to consider whether analysts have valid reasons for their targets, particularly in light of any recent company or industry developments. A high target price can reflect confidence in future performance but could also lead to revisions if the targets become outdated. Investors should conduct thorough research to discern the implications.

![]() 10 ETFs With Most Upside To Analyst Targets

10 ETFs With Most Upside To Analyst Targets

also see:

• Auto Dealerships Dividend Stocks

• MBOT Historical Stock Prices

• Institutional Holders of STRM

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.