First Trust Capital Strength ETF Shows Promising Analyst Upside

In our analysis of ETFs at ETF Channel, we examined the trading prices of the underlying holdings in the First Trust Capital Strength ETF (Symbol: FTCS). We compared these prices to the average 12-month forward targets set by analysts. Our findings reveal an implied analyst target price of $99.95 per unit for the FTCS ETF itself.

Currently, FTCS is trading at approximately $87.95 per unit. This indicates a potential upside of 13.64% based on analysts’ targets for its underlying holdings. Notably, three of FTCS’s underlying assets showcase significant upside: TE Connectivity plc (Symbol: TEL), Mastercard Inc (Symbol: MA), and Veralto Corp (Symbol: VLTO). TEL has a recent trading price of $146.17 per share, while the average analyst target is set at $172.21 per share, suggesting a 17.82% upside. Likewise, MA shows a potential 17.03% increase from its recent price of $535.69, towards an analyst target of $626.91 per share. Veralto Corp is forecasted to reach a target price of $112.31 per share, marking a 14.87% rise from its latest trading price of $97.77.

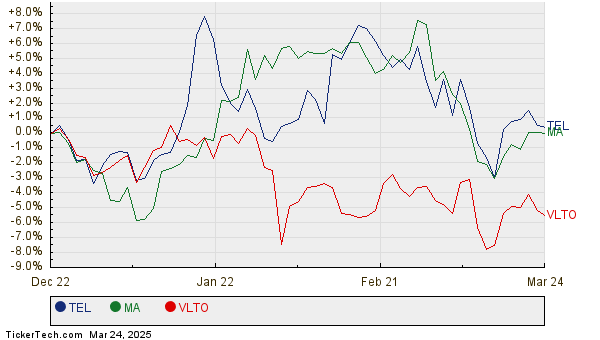

Below is a twelve-month price history chart comparing the performances of TEL, MA, and VLTO:

Together, TEL, MA, and VLTO constitute 5.93% of the First Trust Capital Strength ETF. Below is a summary table highlighting the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| First Trust Capital Strength ETF | FTCS | $87.95 | $99.95 | 13.64% |

| TE Connectivity plc | TEL | $146.17 | $172.21 | 17.82% |

| Mastercard Inc | MA | $535.69 | $626.91 | 17.03% |

| Veralto Corp | VLTO | $97.77 | $112.31 | 14.87% |

As we consider these analyst targets, it’s worth pondering whether they are justified or overly optimistic. Are analysts accurately reflecting recent company and industry shifts, or are their targets lagging behind the current market realities? A high price target for a stock, compared to its trading price, can signal optimism about future performance. However, it can also hint at potential target price downgrades if the predictions are no longer relevant. Investors should research further to answer these critical questions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

Healthcare Dividend Stock List

GBTG Options Chain

RYAN shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.