JPMorgan’s JVAL ETF Shows Promise with Analyst Targets Indicating Upside Potential

Analysts are optimistic about the JPMorgan US Value Factor ETF (Symbol: JVAL), with a projected 12-month price target of $51.01 per unit, based on its underlying holdings. Currently, JVAL trades at about $44.87 per unit, suggesting an upside of 13.69%.

Key Holdings Driving Potential Gains

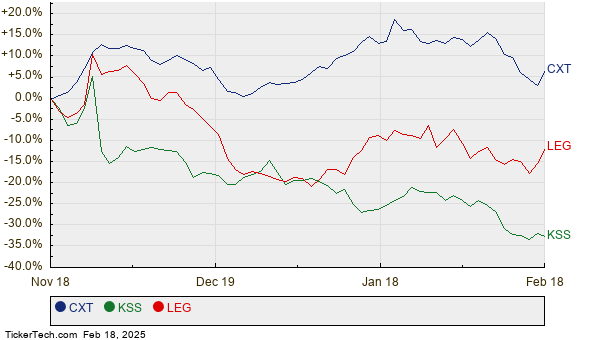

Significant upside can be observed in three of JVAL’s underlying stocks: Crane NXT Co (Symbol: CXT), Kohl’s Corp. (Symbol: KSS), and Leggett & Platt, Inc. (Symbol: LEG). CXT trades at $59.81 per share but analysts expect a rise to an average target of $79.00, representing an increase of 32.08%. Meanwhile, KSS, currently priced at $11.72, has an analyst target of $13.75, indicating a potential upside of 17.32%. For LEG, the shares recently traded at $10.45, with an analyst target price of $12.00, suggesting a rise of 14.83%. Below is a chart detailing the price performances of these companies over the past twelve months:

Current Analyst Price Targets

The following table summarizes the recent trading prices and analyst targets for the stocks discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| JPMorgan US Value Factor ETF | JVAL | $44.87 | $51.01 | 13.69% |

| Crane NXT Co | CXT | $59.81 | $79.00 | 32.08% |

| Kohl’s Corp. | KSS | $11.72 | $13.75 | 17.32% |

| Leggett & Platt, Inc. | LEG | $10.45 | $12.00 | 14.83% |

What Do Analyst Predictions Mean for Investors?

Investors may wonder if these targets are realistic or overly ambitious. Analysts often predict price targets based on various factors, but a high target could be seen as a sign of optimism or, conversely, a sign of outdated expectations. Investors should consider these aspects before making any decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• Stocks Where Yields Got More Juicy

• DRUA Videos

• SDRL Stock Predictions

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.