Analysts See Potential Upside for SPDR S&P MIDCAP 400 ETF Trust (MDY)

In our recent analysis at ETF Channel, we examined the trading prices of the SPDR S&P MIDCAP 400 ETF Trust (Symbol: MDY) and its underlying holdings. We calculated the weighted average implied target price based on the average analyst projections for these holdings. The result? Analysts project an implied target price of $667.20 per unit for MDY.

Current Valuation and Analyst Predictions

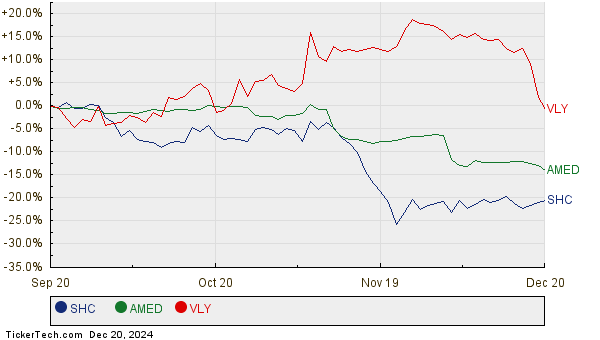

As MDY trades around $568.32 per unit, this suggests a potential upside of 17.40% according to analyst estimates. Three holdings within MDY, specifically Sotera Health Co (Symbol: SHC), Amedisys, Inc. (Symbol: AMED), and Valley National Bancorp (Symbol: VLY), are noteworthy for their expected gains. For instance, SHC is currently priced at $13.27 per share, while analysts have set an average target of $16.19 per share, indicating a 21.98% increase. Similarly, AMED, trading at $83.78, has a potential upside of 20.38% to an average target of $100.86. VLY is also projected to rise, with an average target price of $10.80, a 19.87% increase from its recent price of $9.01.

Below is a twelve-month price history chart for SHC, AMED, and VLY:

Summary of Analyst Target Prices

Here’s a summary table highlighting the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P MIDCAP 400 ETF Trust ETF | MDY | $568.32 | $667.20 | 17.40% |

| Sotera Health Co | SHC | $13.27 | $16.19 | 21.98% |

| Amedisys, Inc. | AMED | $83.78 | $100.86 | 20.38% |

| Valley National Bancorp | VLY | $9.01 | $10.80 | 19.87% |

Analyzing Analyst Outlooks

Are analysts too confident in their projections, or do they have sound reasoning? Understanding the factors influencing these target prices is essential. High targets compared to current stock prices may indicate optimism but could lead to revisions if the targets no longer align with current market realities. Investors are encouraged to conduct further research to assess the validity of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

LICY Videos

LCDX Insider Buying

Walgreens Boots Alliance market cap history

The views and opinions expressed herein are those of the author and do not reflect the views of Nasdaq, Inc.