Analysts See Substantial Upside for QDPL ETF and Key Holdings

At ETF Channel, our analysis of the ETFs within our coverage universe indicates key insights into the trading dynamics of underlying holdings. Using the current trading price of each holding together with the average 12-month forward target set by analysts, we calculated the weighted average implied analyst target price for the Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF (Symbol: QDPL). This analysis shows an implied target price of $44.07 per unit for the ETF.

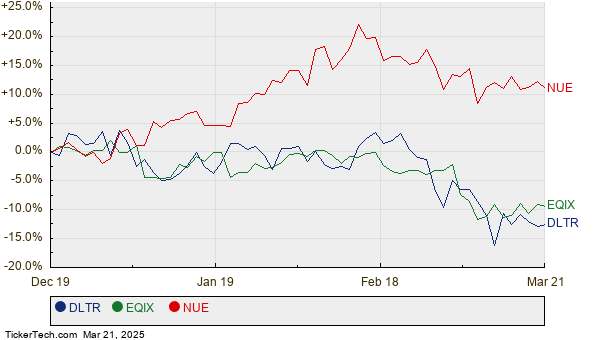

Currently, with QDPL trading around $37.32 per unit, this implies an 18.08% upside potential based on the average analyst targets for its underlying holdings. Notable contributors to this upside include three of QDPL’s holdings: Dollar Tree Inc (Symbol: DLTR), Equinix Inc (Symbol: EQIX), and Nucor Corp. (Symbol: NUE). Specifically, Dollar Tree shares are priced at $64.57, while analysts suggest a target of $82.00, indicating a potential increase of 26.99%. Equinix’s current share price of $851.72 has an upside of 20.68%, with an analyst target of $1,027.84. Meanwhile, analysts project a 19.55% increase for Nucor, whose target price of $154.82 stands above its recent price of $129.50. Below is a chart showing the 12-month price history of DLTR, EQIX, and NUE:

For further clarity, here’s a summary table outlining the current analyst target prices for the mentioned companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Pacer Metaurus US Large Cap Dividend Multiplier 400 ETF | QDPL | $37.32 | $44.07 | 18.08% |

| Dollar Tree Inc | DLTR | $64.57 | $82.00 | 26.99% |

| Equinix Inc | EQIX | $851.72 | $1,027.84 | 20.68% |

| Nucor Corp. | NUE | $129.50 | $154.82 | 19.55% |

These forecasts lead to important questions about the realism of these analyst targets. Are analysts justifiably optimistic regarding where these stocks will be trading in the next 12 months? Do they adequately consider recent developments in the companies and their respective industries? While a high price target in comparison to a stock’s current trading price may suggest overall optimism, it may also signal possible future target price downgrades should these projections prove overly optimistic. Investors should conduct thorough research to answer these critical questions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Funds Holding ADRO

• APPF Stock Predictions

• Funds Holding GRAF

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.