Analysts See Significant Upside for FNDX and Key Holdings

In our examination of holdings within the ETFs covered by ETF Channel, we assessed the trading price of each asset against the average 12-month forward target price set by analysts. The Schwab Fundamental U.S. Large Company Index ETF (Symbol: FNDX) shows an implied analyst target price of $27.11 per unit based on its underlying holdings.

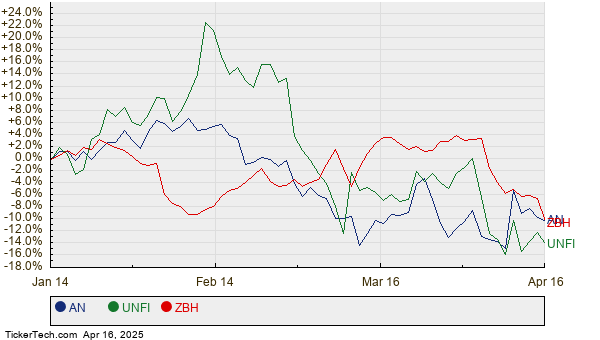

Currently, FNDX is trading at approximately $22.22 per unit. This situation suggests that analysts project a potential upside of 22.03% for this ETF as they analyze the average target prices of its underlying assets. Notably, three of FNDX’s holdings demonstrate considerable upside potential relative to their analyst target prices: AutoNation, Inc. (Symbol: AN), United Natural Foods Inc. (Symbol: UNFI), and Zimmer Biomet Holdings Inc. (Symbol: ZBH). For instance, AutoNation, with a recent trading price of $163.90 per share, has an average analyst target of $206.10, indicating a striking 25.75% upside. Similarly, United Natural Foods, priced at $24.05, has an upside of 23.81%, with an average target price of $29.78. Analysts expect Zimmer Biomet to reach an average target price of $120.38 per share, representing a 23.75% increase from its recent price of $97.27. Below is a twelve-month price history chart that compares the stock performance of AN, UNFI, and ZBH:

Additionally, here is a summary table that outlines the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Schwab Fundamental U.S. Large Company Index ETF | FNDX | $22.22 | $27.11 | 22.03% |

| AutoNation, Inc. | AN | $163.90 | $206.10 | 25.75% |

| United Natural Foods Inc. | UNFI | $24.05 | $29.78 | 23.81% |

| Zimmer Biomet Holdings Inc | ZBH | $97.27 | $120.38 | 23.75% |

As we consider these projections, it is important to question whether analysts are justified in their targets or if they are being overly optimistic about the future stock prices. Are their targets grounded in solid reasoning, or could they be out of touch with the latest developments affecting these companies and the broader market? A significant gap between a high target price and a stock’s current trading price may reflect bullish sentiment, yet it can also signal potential downgrades if those targets do not align with evolving market conditions. These factors are essential for investors to investigate further.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

IJS YTD Return

Institutional Holders of CNDT

PBR Options Chain

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.