Analysts Predict Strong Upside for Avantis Responsible ETF

Our analysis at ETF Channel evaluates the underlying holdings of ETFs, comparing each holding’s trading price to the average analyst 12-month forward target price. For the Avantis Responsible U.S. Equity ETF (Symbol: AVSU), we determined that the weighted average implied target price based on its underlying holdings is $75.77 per unit.

Currently, with AVSU trading around $60.19 per unit, analysts anticipate a 25.88% upside. This projection reflects the average target prices of AVSU’s constituent holdings. Notably, three underlying stocks show significant upside potential: Vanda Pharmaceuticals Inc (Symbol: VNDA), JAKKS Pacific Inc (Symbol: JAKK), and Methode Electronics Inc (Symbol: MEI).

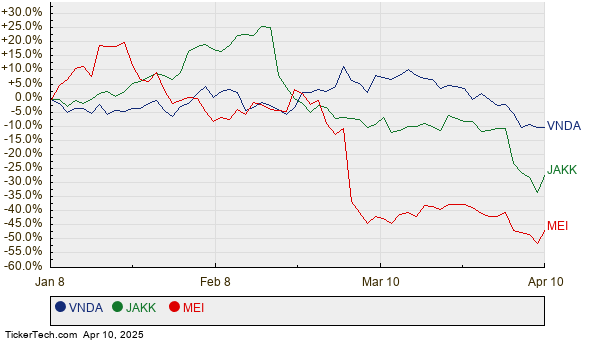

VNDA shares have been priced recently at $4.13, but the average analyst target stands at $12.67, representing a 206.68% increase. JAKK’s recent trading price of $20.55 suggests a potential 109.25% rise if it reaches the target of $43.00. Meanwhile, MEI’s current price of $5.96 has an average analyst target of $11.50, equating to a 92.95% expected increase. Below, we present a twelve-month price history chart that tracks the performance of VNDA, JAKK, and MEI:

Here’s a succinct summary table detailing the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Avantis Responsible U.S. Equity ETF | AVSU | $60.19 | $75.77 | 25.88% |

| Vanda Pharmaceuticals Inc | VNDA | $4.13 | $12.67 | 206.68% |

| JAKKS Pacific Inc | JAKK | $20.55 | $43.00 | 109.25% |

| Methode Electronics Inc | MEI | $5.96 | $11.50 | 92.95% |

The credibility of these analyst targets raises essential questions: Are they grounded in current market realities, or are they overly optimistic? Will these projections hold up against industry changes and company developments that may affect future stock performance? A high target price compared to an asset’s trading price often indicates favorable outlooks. However, such optimism can also risk downgrades if earlier forecasts no longer align with the evolving market conditions. Investors should conduct further research to gauge the legitimacy of these targets.

![]() Find out more about the top 10 ETFs with the most upside to analyst targets.

Find out more about the top 10 ETFs with the most upside to analyst targets.

also see:

• CAFI Insider Buying

• Institutional Holders of BRO

• PROP Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.