Vanguard Small-Cap ETF Analysts See Potential Growth Ahead

In our review of ETFs at ETF Channel, we examined the holdings of the Vanguard Small-Cap ETF (Symbol: VB). By comparing the trading prices of its underlying assets to analysts’ 12-month target prices, we calculated a weighted average target price for the ETF itself, which stands at $283.39 per unit.

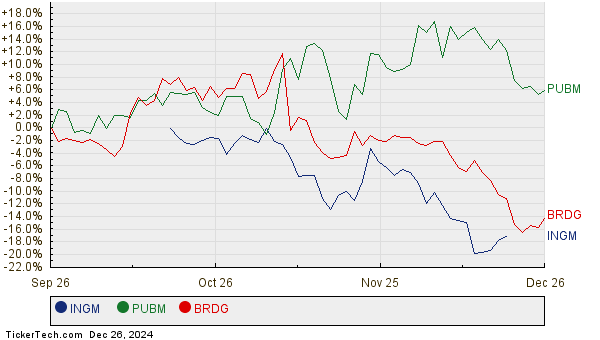

Currently, VB trades at approximately $243.92 per unit. This indicates that analysts anticipate a potential upside of 16.18% based on their target projections. Notably, three holdings of VB are expected to perform particularly well: Ingram Micro Holding Corp (Symbol: INGM), PubMatic Inc (Symbol: PUBM), and Bridge Investment Group Holdings Inc (Symbol: BRDG). Ingram Micro’s recent trading price is $20.43 per share, while analysts project a target price of $27.86, reflecting a potential upside of 36.35%. Similarly, PubMatic, priced at $15.37, has an expected target of $19.88, suggesting a 29.31% increase. For Bridge Investment Group, which currently trades at $8.66 per share, analysts anticipate a target price of $10.70—representing a 23.56% upside. Below is a chart showcasing the 12-month performance history for INGM, PUBM, and BRDG:

Here’s a summary table detailing the analyst target prices for these companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Small-Cap ETF | VB | $243.92 | $283.39 | 16.18% |

| Ingram Micro Holding Corp | INGM | $20.43 | $27.86 | 36.35% |

| PubMatic Inc | PUBM | $15.37 | $19.88 | 29.31% |

| Bridge Investment Group Holdings Inc | BRDG | $8.66 | $10.70 | 23.56% |

Questions arise regarding the realism of these targets. Are analysts correctly assessing the potential growth of these stocks, or are they being too optimistic? An inflated target price can signal positive future expectations but may also lead to reductions if the estimates do not align with current market conditions. Investors are encouraged to conduct further research and analysis regarding these outlooks.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Largest Discount Preferreds

• GXP Price Target

• BMCH Insider Buying

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.