Vanguard Dividend Appreciation ETF Analyst Targets Suggest Potential Upside

ETF Channel has analyzed the underlying holdings of the Vanguard Dividend Appreciation ETF (Symbol: VIG) to determine its potential price based on analyst forecasts. The weighted average target price for VIG is currently calculated at $223.23 per unit.

VIG’s Current Price Indicates Possible Growth

As VIG is presently trading around $201.05 per unit, analysts believe there is an 11.03% upside to this ETF according to the price targets of its underlying assets. Notably, several holdings show promise for significant price increases. Three key stocks with favorable projections are First Mid Bancshares Inc (Symbol: FMBH), TriCo Bancshares (Symbol: TCBK), and Worthington Enterprises Inc (Symbol: WOR).

Highlighting Stock Performances

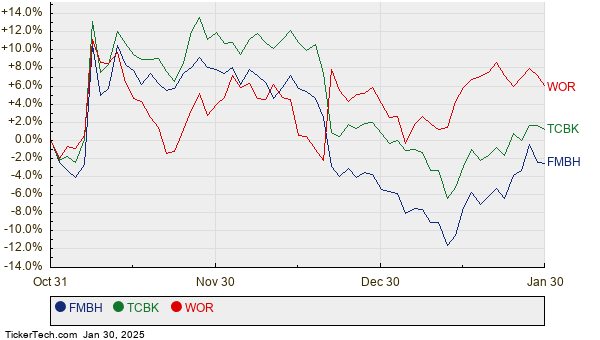

First Mid Bancshares Inc, currently priced at $38.13 per share, has an average analyst target of $45.86, indicating a potential upside of 20.26%. Similarly, TriCo Bancshares, trading at $44.15, has an upside of 15.89% with a target price of $51.17. Worthington Enterprises Inc is also valued at $41.34, with an expected target price of $46.00, reflecting an 11.27% increase. Below is a chart showcasing the twelve-month performance of these stocks:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Dividend Appreciation ETF | VIG | $201.05 | $223.23 | 11.03% |

| First Mid Bancshares Inc | FMBH | $38.13 | $45.86 | 20.26% |

| TriCo Bancshares | TCBK | $44.15 | $51.17 | 15.89% |

| Worthington Enterprises Inc | WOR | $41.34 | $46.00 | 11.27% |

Implications of Analyst Projections

Given these targets, investors might wonder whether analysts are being overly optimistic or if their forecasts are reasonable based on recent developments in the market. A high target relative to a stock’s current price suggests a positive outlook, but could also signal the possibility of future downgrades if market conditions change. Investors should conduct thorough research to gauge the validity of these targets.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Global Payments market cap history

• VRSN MACD

• BLNG market cap history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.