Analysts See Upside Potential for Vanguard Value ETF and Key Holdings

The latest analysis from ETF Channel reveals that the Vanguard Value ETF (Symbol: VTV) has an implied target price of $195.36 per unit, suggesting significant growth potential based on its underlying stocks.

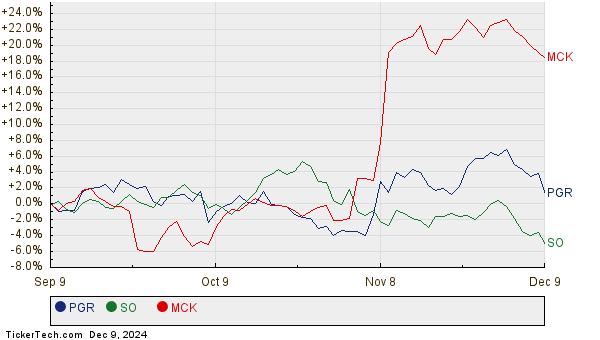

Currently, VTV trades at around $178.30 per unit, indicating a 9.57% upside potential according to analyst forecasts for its holdings. Among these holdings, Progressive Corp. (Symbol: PGR), Southern Company (Symbol: SO), and McKesson Corp. (Symbol: MCK) stand out with considerable upside to their target prices. Specifically, PGR, which is priced at $254.56/share, has an average analyst target of $280.70/share—10.27% higher. Similarly, SO shows 10.08% upside from its recent price of $84.81, with a target price of $93.36/share. Lastly, MCK’s target price is set at $662.47/share, representing a 9.77% increase from its current price of $603.53. The following chart illustrates the price performance of these stocks over the past year:

Here’s a summary of the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Value ETF | VTV | $178.30 | $195.36 | 9.57% |

| Progressive Corp. | PGR | $254.56 | $280.70 | 10.27% |

| Southern Company | SO | $84.81 | $93.36 | 10.08% |

| McKesson Corp | MCK | $603.53 | $662.47 | 9.77% |

These analysts’ price targets raise important questions: Are the expectations realistic, or are they overly optimistic? Investors should consider whether analysts have adequately factored in the latest company news and trends within the industry. While a high target price can suggest strong future potential, it might also indicate an impending reassessment if based on outdated information. These considerations warrant careful examination by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Institutional Holders of LI

• Institutional Holders of FLIC

• PACK Insider Buying

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.