Understanding Analyst Ratings: Meta Platforms Under the Microscope

Wall Street analysts’ recommendations play a significant role in guiding investors’ decisions on stocks. When these analysts alter their ratings, it can have a direct impact on stock prices. However, a key question arises: how reliable are these recommendations?

Before diving into the credibility of brokerage suggestions and how to leverage them, let’s explore what analysts think about Meta Platforms (META).

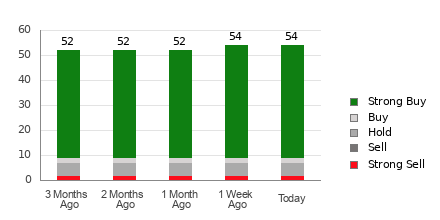

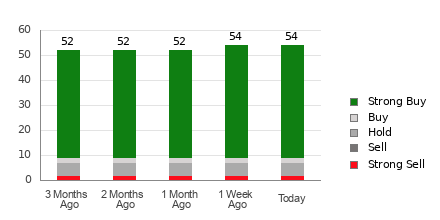

Currently, Meta Platforms boasts an average brokerage recommendation (ABR) of 1.37, on a scale from 1 to 5 (ranging from Strong Buy to Strong Sell). This rating reflects assessments made by 54 brokerage firms. An ABR of 1.37 indicates a position between Strong Buy and Buy.

Among the 54 recommendations contributing to this ABR, 45 are categorized as Strong Buy, while two are rated as Buy. This means that Strong Buy and Buy recommendations represent 83.3% and 3.7% of all inputs, respectively.

Current Trends in META Brokerage Recommendations

For more information on Meta Platforms’ price target and stock forecast, check here>>>

While an ABR suggesting a buy for Meta Platforms is promising, relying solely on this information for investment decisions may not be advisable. Several studies indicate that brokerage recommendations have limited success in helping investors select stocks with growth potential.

Why is this the case? Brokerage analysts often maintain a positive bias due to their firms’ vested interests in the stocks they cover. Research reveals that brokerage firms typically issue five “Strong Buy” recommendations for every “Strong Sell.”

This tendency suggests that brokerage analysts’ interests may not always align with those of individual investors, offering little guidance on future stock performance. Therefore, it’s prudent to use this data as a support for your own analysis or alongside proven tools that effectively forecast stock price movements.

Zacks Rank, a stock rating tool backed by external audits, segments stocks into five categories from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It effectively predicts near-term price performance based on earnings estimate revisions. Consequently, verifying the ABR against the Zacks Rank may enhance your investment strategy.

Differentiating Zacks Rank from ABR

While both Zacks Rank and ABR are expressed within a range of 1-5, they evaluate different aspects.

ABR is based solely on brokerage recommendations and is typically displayed in decimal form (e.g., 1.28). In contrast, Zacks Rank is a quantitative model focused on earnings estimate changes and is represented as whole numbers — from 1 to 5.

Brokerage analysts, due to their firms’ interests, tend to show excessive optimism in their recommendations. This bias can mislead investors more often than guide them correctly.

Alternatively, Zacks Rank focuses on earnings estimate revisions. Research demonstrates a strong connection between these revisions and subsequent stock price movements.

Additively, the Zacks Rank is uniformly applied across all stocks for which there are earnings estimates for the current year, ensuring a balanced representation within its five ranks.

Another difference lies in timeliness. The ABR may not always reflect the most current data. Brokerage analysts regularly adjust their earnings estimates to align with changing business dynamics, and these updates are quickly represented in the Zacks Rank, making it a timely indicator of future price shifts.

Assessing META as an Investment

Recent updates on earnings estimates for Meta Platforms show that the Zacks Consensus Estimate for the current year has risen by 5.9% over the past month, now standing at $26.66.

Analysts’ growing optimism regarding the company’s earnings, reflected in their upward revisions of EPS estimates, suggests that the stock may experience significant growth soon.

The scale of this change in the consensus estimate, along with other related factors, has earned Meta Platforms a Zacks Rank #2 (Buy). For those interested, you can find today’s Zacks Rank #1 (Strong Buy) stocks listed here >>>>

As such, the Buy-equivalent ABR for Meta Platforms may serve as a valuable reference for investors.

Expert Insights on Top Stocks

Amid an extensive list of stocks, five Zacks experts have each identified a favorite that they believe could surge +100% or more soon. Among these, Director of Research Sheraz Mian has singled out one stock expected to deliver substantial gains.

This chosen company focuses on millennial and Gen Z customers, boasting nearly $1 billion in revenue in the last quarter alone. A recent market pullback presents a prime opportunity for potential investors. While not every recommended stock will succeed, this selection has the potential to outperform others previously highlighted, such as Nano-X Imaging, which jumped +129.6% in under nine months.

For more information on our recommended stock and four additional contenders, please click here.

Meta Platforms, Inc. (META): Access your free stock analysis report here.

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.