Analyst Insights Reveal Potential Upside for Capital Group Dividend Value ETF

At ETF Channel, we analyzed the underlying holdings of various ETFs in our coverage. Our focus has been on the Capital Group Dividend Value ETF (Symbol: CGDV). We compared the trading prices of each holding with the average 12-month forward target prices provided by analysts. From this analysis, we calculated that the implied target price for CGDV is $41.52 per unit based on its underlying assets.

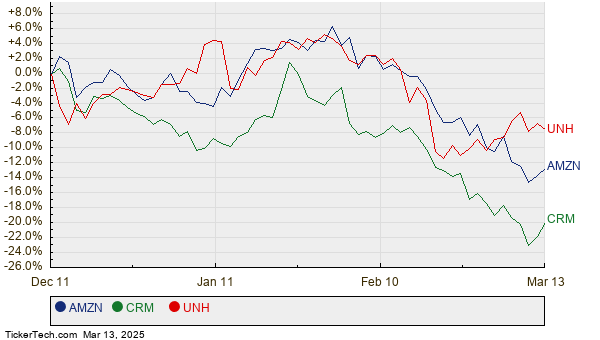

The ETF is currently trading at around $35.64 per unit, suggesting a potential upside of 16.51% according to analyst forecasts. Notably, three of CGDV’s underlying assets—Amazon.com Inc (Symbol: AMZN), Salesforce Inc (Symbol: CRM), and UnitedHealth Group Inc (Symbol: UNH)—show significant upside potential. AMZN trades at a recent price of $198.93 per share, while the average analyst target is $268.66 per share, indicating a 35.05% upside. Similarly, CRM, priced at $284.88, has a target of $379.37, suggesting an upside of 33.17%. Analysts project UNH to reach $637.12 per share, which is 32.44% above its recent price of $481.06. Below is a twelve-month price history chart comparing the stock performance of AMZN, CRM, and UNH:

Together, these three companies make up 5.68% of the Capital Group Dividend Value ETF’s holdings. Below is a summary table detailing the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Capital Group Dividend Value ETF | CGDV | $35.64 | $41.52 | 16.51% |

| Amazon.com Inc | AMZN | $198.93 | $268.66 | 35.05% |

| Salesforce Inc | CRM | $284.88 | $379.37 | 33.17% |

| UnitedHealth Group Inc | UNH | $481.06 | $637.12 | 32.44% |

Investors may wonder whether analysts’ targets reflect realistic expectations or overly optimistic forecasts. The potential for high target prices relative to current trading values could indicate confidence in future performance but may also lead to price target downgrades if market conditions shift. Investors are encouraged to conduct further research to gather insights.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Low Beta Stocks

• OBLG Insider Buying

• WAL Next Dividend Date

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.