Analysts Project Upside Potential for Vanguard Russell 1000 Value ETF

In our analysis of various ETFs, ETF Channel has evaluated the trading price of each underlying holding against the average analyst 12-month forward target price. The findings for the Vanguard Russell 1000 Value ETF (Symbol: VONV) reveal an implied analyst target price of $91.59 per unit.

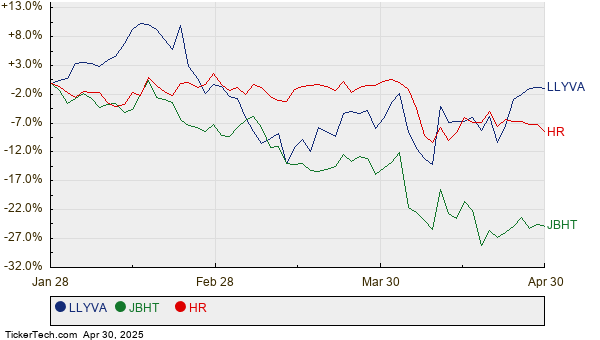

With VONV currently trading around $79.90 per unit, analysts project a potential upside of 14.63% based on the average target prices of its underlying holdings. Among these holdings, three companies stand out: Liberty Media CorpLiberty Live (Symbol: LLYVA), J.B. Hunt Transport Services, Inc. (Symbol: JBHT), and Healthcare Realty Trust Incorporated (Symbol: HR). For instance, LLYVA has a recent trading price of $70.97 per share, while the average analyst target sits at $89.00, indicating a potential increase of 25.41%. Similarly, JBHT’s recent price of $130.40 suggests an upside of 15.54%, with an average target price of $150.67. Analysts also predict that HR will reach a target price of $17.72 per share, reflecting a 15.23% upside from its recent price of $15.38. The chart below illustrates the twelve-month price history of LLYVA, JBHT, and HR:

The following summary table provides a concise overview of the current analyst target prices discussed above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Value ETF | VONV | $79.90 | $91.59 | 14.63% |

| Liberty Media CorpLiberty Live | LLYVA | $70.97 | $89.00 | 25.41% |

| J.B. Hunt Transport Services, Inc. | JBHT | $130.40 | $150.67 | 15.54% |

| Healthcare Realty Trust Incorporated | HR | $15.38 | $17.72 | 15.23% |

Are analysts justified in their targets, or are they overly optimistic about these stocks a year from now? This raises important questions regarding the validation of their projections in light of recent developments in the companies and the industry. A high target price compared to a stock’s current trading price might suggest optimism; however, it could also indicate preparedness for potential target price downgrades if the assumptions turn out to be misguided. Investors should conduct further research to make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Related Topics:

• Top Ten Hedge Funds Holding NUHY

• Funds Holding PQIN

• Asset Management Mergers and Acquisitions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.