Alibaba Shows Steady Growth Amid Market Challenges

Alibaba’s BABA recent second-quarter fiscal 2025 results reveal growth, despite some hurdles in the market. Revenues reached $33.7 billion, surpassing the Zacks Consensus Estimate by 0.69%. However, non-GAAP earnings of $2.15 per ADS fell 4.87% short of expectations, primarily due to heightened strategic investments across key areas.

Strong E-commerce Business and Enhanced Monetization

The domestic e-commerce division remains robust, with platforms Taobao and Tmall achieving increased monthly active users. A recently introduced 0.6% software service fee and the rising popularity of the AI-driven Quanzhantui marketing tool have improved monetization efforts. The success of the 11.11 Global Shopping Festival, marked by record monthly active users, highlights strong consumer interest. Moreover, the 88VIP membership program has grown to 46 million members, indicating rising customer loyalty and potential for sustained revenue growth.

Cloud Computing and AI: Key Growth Drivers

Alibaba Cloud emerges as a significant contributor to the company’s growth, with revenues (excluding consolidated subsidiaries) increasing by 7% quarter over quarter. The focus on AI within the cloud segment has yielded impressive results, maintaining triple-digit growth in AI-related products for five consecutive quarters. This dedication to enhancing AI infrastructure positions Alibaba well to meet the surging demand for cloud and AI services across various sectors.

International Growth and Strategic Investments

The Alibaba International Digital Commerce segment displayed strong momentum, with 29% revenue growth, fueled by successful expansions into key markets. The AliExpress Choice initiative continues to see significant growth while improving overall unit economics. Strategic investments in European and Gulf region markets, combined with the launch of AI-powered tools like a new B2B search engine, underscore the company’s commitment to global expansion and technological innovation.

Stock Performance and Valuation Analysis

As of year-to-date, the stock has returned 11.9%, lagging behind the Zacks Internet-Commerce industry’s 30%, the Zacks Retail-Wholesale sector’s 23.2%, and the S&P 500’s return of 24.5%.

Alibaba’s prominent e-commerce position in China faces competition from global giants such as Amazon AMZN and eBay EBAY. Additionally, BABA’s growth in the global cloud sector is challenged by leading players like Amazon, Microsoft, and Alphabet’s GOOGL Google.

2023 Year-to-Date Performance Summary

Image Source: Zacks Investment Research

Currently, Alibaba is trading at a forward 12-month Price/Earnings ratio of 8.38X, compared to the industry’s 24.63X and below the median of 15.56X. This valuation indicates that Alibaba’s stock is significantly undervalued relative to its industry peers, trading at less than half the average P/E ratio. The lower-than-median forward P/E suggests an attractive entry point for investors, as the stock is perceived to be trading below its fair market value, backed by solid fundamentals. The company also boasts a Value Score of A, which adds to its appeal.

BABA’s P/E F12M Ratio Highlights Valuation Discount

Image Source: Zacks Investment Research

Investment Outlook for Alibaba

From an investment angle, multiple factors make Alibaba a compelling buy at this juncture. The company’s aggressive share repurchase program, with approximately $10 billion spent in the first half of fiscal 2025, reflects confidence in its long-term viability. Following its primary listing in Hong Kong and inclusion in the Southbound Stock Connect, Alibaba has broadened its investor base, with net inflows of HK$46 billion, signaling strong institutional interest.

While elevated investments may weigh on short-term profitability, Alibaba’s strategic focus on core business growth, AI advancements, and international expansion offers attractive long-term potential. Furthermore, the company’s solid net cash position of $50.2 billion provides significant flexibility to pursue growth initiatives without sacrificing financial stability.

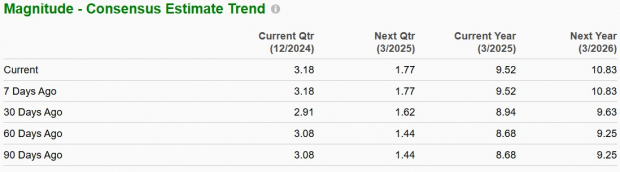

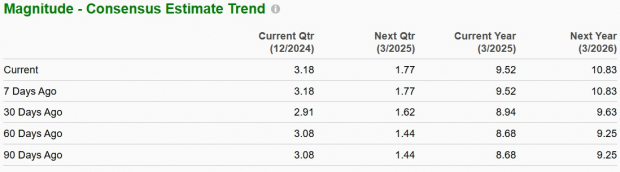

The Zacks Consensus Estimate for fiscal 2025 revenues stands at $140.46 billion, reflecting a 7.63% year-over-year increase. Additionally, the earnings estimate for fiscal 2025 has seen a recent upward revision of 3% over the past month to $8.94 per share, indicating growing market confidence in Alibaba’s growth trajectory.

Image Source: Zacks Investment Research

Stay updated with the latest earnings forecasts on the Zacks Earnings Calendar.

Conclusion

Despite heightened competition in the e-commerce space, Alibaba’s diversified growth strategy, improved operational efficiency in struggling units, and leadership in cloud computing and AI put it in a favorable position for investors looking to tap into China’s digital economy. Currently, BABA stock holds a Zacks Rank #1 (Strong Buy), suggesting strong optimism for future performance. Access the complete list of today’s Zacks #1 Rank stocks here.

An Exciting Stock Pick for a Potential Doubling

Among thousands of stocks, 5 Zacks analysts have selected their top choices likely to skyrocket +100% or more soon. Out of these, Director of Research Sheraz Mian has identified one with the greatest upside potential.

This company targets millennial and Gen Z audiences, bringing in nearly $1 billion in revenue last quarter. A recent price pullback serves as a prime opportunity. While not all of our elite picks achieve success, this one may outperform earlier Zacks’ Stocks Set to Double, like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: Discover Our Top Stock And 4 Runners Up

Interested in getting Zacks Investment Research’s latest recommendations? Download 5 Stocks Set to Double for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.