The Allstate Corporation ALL is aided by rate increases, sound investment results, acquisitions, declining expenses and a commendable financial position.

Top Zacks Rank & Upbeat Price Performance

Allstate currently sports a Zacks Rank #1 (Strong Buy).

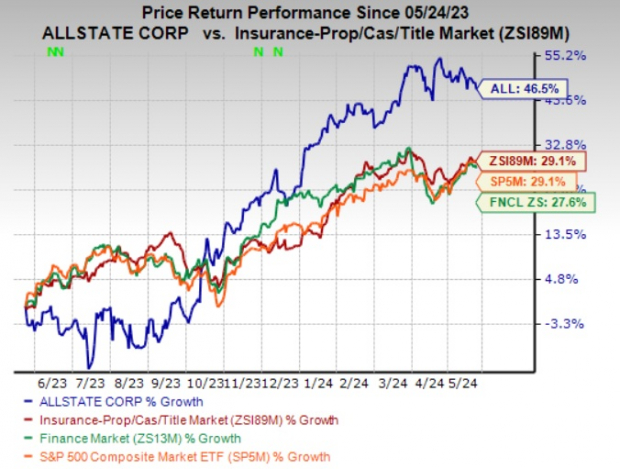

The stock has gained 46.5% in the past year compared with the industry’s 29.1% growth. The Zacks Finance sector has increased 27.6% while the S&P 500 composite has risen 29.1% in the same time frame.

Image Source: Zacks Investment Research

Favorable Style Score

ALL carries an impressive Value Score of B. Value Score helps find stocks that are undervalued. Back-tested results have shown so far that stocks with a favorable Value Score in combination with a solid Zacks Rank are the best investment bets.

Robust Growth Prospects

The Zacks Consensus Estimate for Allstate’s 2024 earnings is pegged at $15.15 per share, which indicates a nearly 16-fold increase from the prior-year reported figure. The consensus mark for revenues is $63.7 billion, which indicates an improvement of 11% from the year-ago reported figure.

The consensus estimate for 2025 earnings is pegged at $17.33 per share, suggesting 14.4% growth from the 2024 estimate. The consensus mark for revenues is $68 billion, indicating an improvement of 6.7% from the 2024 estimate.

Northbound Estimate Revision

The Zacks Consensus Estimate for 2024 earnings has been revised upward 1.1% in the past seven days.

Decent Earnings Surprise History

ALL’s bottom line outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 41.88%.

Solid Return on Equity

The return on equity for Allstate is 14.4%, which is higher than the industry average of 7.8%. This substantiates the company’s efficiency in utilizing shareholders’ funds.

Key Business Tailwinds

Revenues of Allstate continue to gain on the back of higher property and casualty (P&C) insurance premiums that stem from continued rate increases. P&C insurance premiums earned improved 10.9% year over year in the first quarter. Management remains optimistic about implementing additional rate hikes in its auto insurance business in 2024.

An improved interest rate scenario is likely to boost the investment yields of Allstate in the days ahead. Its market-based investment income received an impetus in the first quarter from increased yields on fixed-income securities. Meanwhile, private equity valuation increases drive ALL’s performance-based investment income.

The insurer resorts to acquisitions in a bid to expand its capabilities and nationwide presence. Such buyouts provide an impetus to Allstate’s top-line growth as well. One such example is the National General acquisition in 2021, which continues to boost ALL’s revenue growth.

Allstate’s efforts to emerge as a cost-effective digital insurer require special mention, keeping in mind the ongoing digitization infused across every sphere of life. The decline in operational costs enables it to divert funds for growth and tech-related investments. Total costs and expenses declined 2.8% year over year in the first quarter.

Allstate also follows a remarkable strategy of undertaking divestitures to extract capital out of businesses that fetch lower returns and growth. It is currently pursuing the divestiture of its Health and Benefits businesses.

The insurer boasts an impressive financial position backed by a sound cash balance and robust cash-generating abilities. This financial strength is leveraged to pursue growth-related initiatives and sustain its solid record of returning more value to shareholders via share buybacks and dividend hikes. In February 2024, management approved a 3.4% hike in the quarterly dividend. Its dividend yield of 2.2% compares favorably with the industry’s figure of 0.3%.

Other Stocks to Consider

Some other top-ranked stocks in the insurance space are Arch Capital Group Ltd. ACGL, Palomar Holdings, Inc. PLMR and HCI Group, Inc. HCI, each currently sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Arch Capital’s earnings surpassed estimates in each of the last four quarters, the average surprise being 28.41%. The Zacks Consensus Estimate for ACGL’s 2024 earnings indicates a rise of 1.2% while the consensus mark for revenues suggests an improvement of 18.8% from the respective year-ago actuals. The consensus mark for ACGL’s 2024 earnings has moved 6.5% north in the past 30 days.

Palomar’s earnings beat estimates in each of the trailing four quarters, the average surprise being 15.10%. The Zacks Consensus Estimate for PLMR’s 2024 earnings indicates a rise of 21.7% while the consensus mark for revenues suggests an improvement of 29.6% from the respective year-ago actuals. The consensus mark for PLMR’s 2024 earnings has moved 4.2% north in the past 30 days.

The bottom line of HCI Group outpaced estimates in each of the trailing four quarters, the average surprise being 139.15%. The Zacks Consensus Estimate for HCI’s 2024 earnings indicates a rise of 57.6% while the consensus mark for revenues suggests an improvement of 40.9% from the respective year-ago actuals. The consensus mark for HCI’s 2024 earnings has moved 13.1% north in the past 30 days.

Shares of Arch Capital, Palomar and HCI Group have gained 43%, 67.2% and 75.4%, respectively, in the past year.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

This company targets millennial and Gen Z audiences, generating nearly $1 billion in revenue last quarter alone. A recent pullback makes now an ideal time to jump aboard. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners Up

The Allstate Corporation (ALL) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Palomar Holdings, Inc. (PLMR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.