Amazon’s AI Advancements Drive Growth Amid Valuation Concerns

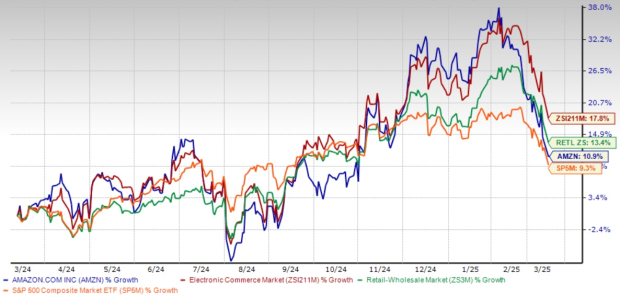

Amazon (AMZN) has seen a return of 10.9% over the past year, largely due to robust business execution and innovative advancements in artificial intelligence (AI). The company’s recent enhancement of its Amazon Bedrock platform has positioned it as a significant player in the competitive enterprise AI landscape.

The announcement of DeepSeek-R1 as a fully managed model on Amazon Bedrock highlights Amazon’s commitment to expanding its AI services. This development makes Amazon the first cloud service provider to offer such a capability, strengthening its AI portfolio. However, analysts are expressing concerns about the company’s stock valuation and its long-term growth potential.

DeepSeek-R1, which has gained attention for its reasoning abilities and cost-effectiveness, allows Amazon to further its AI offerings. This model reportedly delivers advanced reasoning, demonstrating high precision and thorough contextual understanding, while costing between 75-90% less than its competitors.

1-Year Performance

Image Source: Zacks Investment Research

Integration Enhances AWS Security Features

The incorporation of DeepSeek-R1 into Amazon Bedrock enhances security and governance for enterprise clients. All data processed by DeepSeek-R1 is protected through encryption, ensuring that user inputs and model outputs are kept private. This measure is significant for enterprises adopting generative AI solutions.

Moreover, Amazon has established responsible AI guardrails for DeepSeek-R1. These tools allow organizations to personalize content filtering and safeguard sensitive information, addressing increasing global regulatory concerns surrounding AI technologies.

The Bedrock platform also enables the automated evaluation of DeepSeek-R1 against other models, providing enterprises with a systematic method to select the ideal model for their needs through both automated and manual reviews.

The enthusiasm is reflected in the rapid adoption of Amazon Bedrock by major corporations such as Moody’s (MCO), PwC, and Robin AI, signaling growing confidence in Amazon’s AI capabilities.

Competitive Landscape of Amazon Bedrock

Within the enterprise AI sector, Amazon Bedrock encounters stiff competition from Alphabet (GOOGL)-owned Google’s Vertex AI and Microsoft (MSFT) Azure Cognitive Services. Vertex AI is known for its unparalleled flexibility and access to advanced models, such as PaLM 2, appealing to developers seeking customization. Conversely, Azure Cognitive Services leverages deep integration with Microsoft’s ecosystem, bolstering its appeal to existing clients.

Amazon Bedrock distinguishes itself by offering a user-friendly interface, a variety of foundation models accessible via a single API, and security features such as automated reasoning checks to minimize AI hallucinations. These attributes make it especially attractive to businesses that prioritize quick development and ethical AI usage. Additionally, the company is expanding Bedrock’s global reach, with services now available in various AWS regions and multilingual support through Amazon Bedrock Guardrails.

Assessing Amazon’s Financial Performance

Amazon’s fourth-quarter 2024 financial results revealed revenues reaching $187.8 billion, reflecting a 10% increase year-over-year. AWS grew by an impressive 19%, achieving a $115 billion annualized revenue run rate. Operating income surged by 61%, reaching $21.2 billion, indicative of significant profitability growth.

AWS continues to experience growth in both generative AI and other services as organizations pivot to newer initiatives and bring more workloads to the Amazon cloud while also increasing the focus on generative AI solutions.

Nonetheless, Amazon has cautioned that AWS growth may be inconsistent over the next few years due to adoption cycles and capacity limitations. This warning is relevant for investors assessing potential entry points.

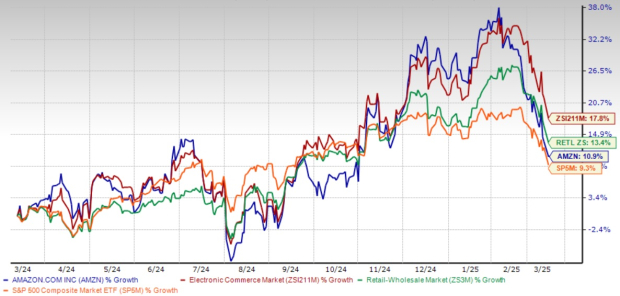

Valuation Metrics Raise Caution

Despite strong fundamentals, Amazon’s valuation metrics prompt scrutiny regarding short-term growth potential. The company’s forward 12-month Price-to-Sales ratio stands at 2.9X, well above the Zacks Internet – Commerce industry average of 2.09X, suggesting that the stock may be fully valued presently.

AMZN’s P/S F12M Ratio Highlights Valuation Concerns

Image Source: Zacks Investment Research

While AWS’s growth and improving profit margins are promising, the company confronts challenges stemming from high capital expenditures tied to AI infrastructure. Amazon anticipates approximately $100 billion in capital expenditures for 2025, primarily aimed at advancing AI capabilities for AWS.

These investments may affect near-term profitability even as they position Amazon for future growth. Additionally, AWS faces supply constraints concerning AI chips and power capacity which could limit near-term growth prospects.

Investment Strategy: Hold and Observe

For current investors in Amazon, the long-term growth narrative remains robust. The company consistently executes well across various sectors while making pivotal investments in AI capabilities that are expected to yield returns in the future.

According to the Zacks Consensus Estimate, Amazon’s net sales for 2025 are projected at $697.68 billion, marking a 9.36% increase from the previous year. The earnings estimate stands at $6.32 per share, reflecting a 14.29% rise compared to the same period last year, with this figure remaining stable over the last 30 days.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks earnings Calendar

Market Insights: Amazon’s Strategic AI Moves and Investment Cautions

Investors eyeing new positions in Amazon.com, Inc. (AMZN) may want to adopt a cautious approach. The company’s high valuation multiples and significant capital expenditures, along with recognized constraints on growth, suggest that more favorable entry points could arise in 2025.

Monitoring Amazon’s AI Integration and Investment Growth

The implementation of DeepSeek-R1 into Amazon Bedrock strengthens the company’s competitive edge in enterprise AI. However, it is crucial for investors to track trends in AWS growth, profit margins, and the returns on the considerable investments being made in AI technologies. Until the market sees a moderation in valuation or clearer financial returns from these investments, a “hold” stance is advisable. Currently, AMZN holds a Zacks Rank #3 (Hold).

Expert Picks: Potential for Profound Gains

Zacks’ Research Chief has recently spotlighted a stock with exceptional potential for growth. The firm’s team has identified five stocks they believe could achieve gains of 100% or more in the next few months. Among these, Director of Research Sheraz Mian emphasizes one that stands out.

This leading pick is recognized for its innovative financial solutions and boasts a rapidly expanding customer base of over 50 million. While not all selected stocks guarantee success, this particular pick has the potential to outperform others like Nano-X Imaging, which surged by 129.6% within nine months.

To explore more, you can access the full report on the top stock and four additional recommendations. For investors seeking the latest insights from Zacks Investment Research, a free download of the “7 Best Stocks for the Next 30 Days” is now available.

Further Stock Analysis

For detailed evaluations, investors can check free stock analysis reports for:

- Amazon.com, Inc. (AMZN)

- Microsoft Corporation (MSFT)

- Moody’s Corporation (MCO)

- Alphabet Inc. (GOOGL)

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.