Amazon Reports Strong Q4 Results, but Guidance Falls Short of Expectations

Amazon’s AMZN recent Q4 results generated significant interest as the company indicated a record holiday shopping season.

Despite beating Q4 sales and earnings estimates, Amazon’s cautious future outlook disappointed some investors. Here’s a closer look at what this means for Amazon stock—should you buy, sell, or hold?

Highlights of Amazon’s Q4 Performance

In Q4, Amazon’s revenue increased by 10% year-over-year, reaching $187.79 billion, surpassing analyst estimates of $187.27 billion. Leading in cloud services, Amazon Web Services (AWS) contributed $28.78 billion, representing 16% of Amazon’s total sales. Although AWS grew from $24.2 billion in the previous year, it slightly missed estimates of $28.83 billion.

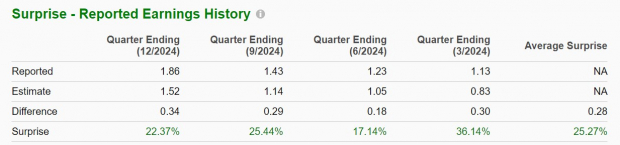

Net income jumped from $10.6 billion to $20 billion or $1.86 per share, marking an impressive 84% increase from last year’s EPS of $1.01. This marked the ninth consecutive quarter where Amazon surpassed earnings expectations. In fact, that record includes topping sales estimates in three of the past four quarterly reports.

Image Source: Zacks Investment Research

Reviewing Amazon’s Annual Results

For the full year of 2024, Amazon’s total sales increased by 11% to $637.96 billion compared to $574.78 billion in 2023. Annual earnings soared 95% to $5.53 per share from $2.84 in 2023, illustrating strong overall financial health.

Image Source: Zacks Investment Research

Concerns Over Amazon’s Future Guidance

Looking ahead, Amazon projected Q1 revenue between $151 billion and $155.5 billion, falling short of many analysts’ expectations of $158 billion. The Zacks Consensus has also been revised down to $154.86 billion, reflecting an 8% growth forecast.

The company’s revised guidance is partly due to unfavorable foreign exchange rates, anticipating a $2.1 billion hit linked to the strong U.S. dollar.

Additionally, analysts are wary of increasing expenses, as Amazon plans a significant investment in AI data centers, with spending expected to rise to $100 billion this year, compared to $83 billion in 2024. While this aligns with industry trends, it raises questions about short-term profitability.

Image Source: Zacks Investment Research

Financial Stability Despite Increased Expenditure

Investors may find reassurance in Amazon’s robust balance sheet. Currently, the company holds $101.2 billion in cash and equivalents and has total assets of $624.89 billion, significantly higher than its total liabilities of $338.92 billion.

Image Source: Zacks Investment Research

Final Thoughts

Currently, Amazon stock holds a Zacks Rank #3 (Hold). While the company remains profitable, its investment in AI infrastructure could pay off in the future. Investors may want to wait for a more favorable buying opportunity.

Just Released: Zacks Top 10 Stocks for 2025

Hurry—now is your chance to access our 10 top stocks for 2025. Curated by Zacks Director of Research, Sheraz Mian, this selection has demonstrated exceptional performance. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks has gained +2,112.6%, significantly outperforming the S&P 500’s +475.6%. Sheraz has scrutinized 4,400 companies to pick the ten most promising stocks to buy and hold this year. Be among the first to discover these just-released investment opportunities with high potential.

See New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Download your copy of 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.