Apple’s Q2 2025 Earnings Report: Market Insights and Analysis

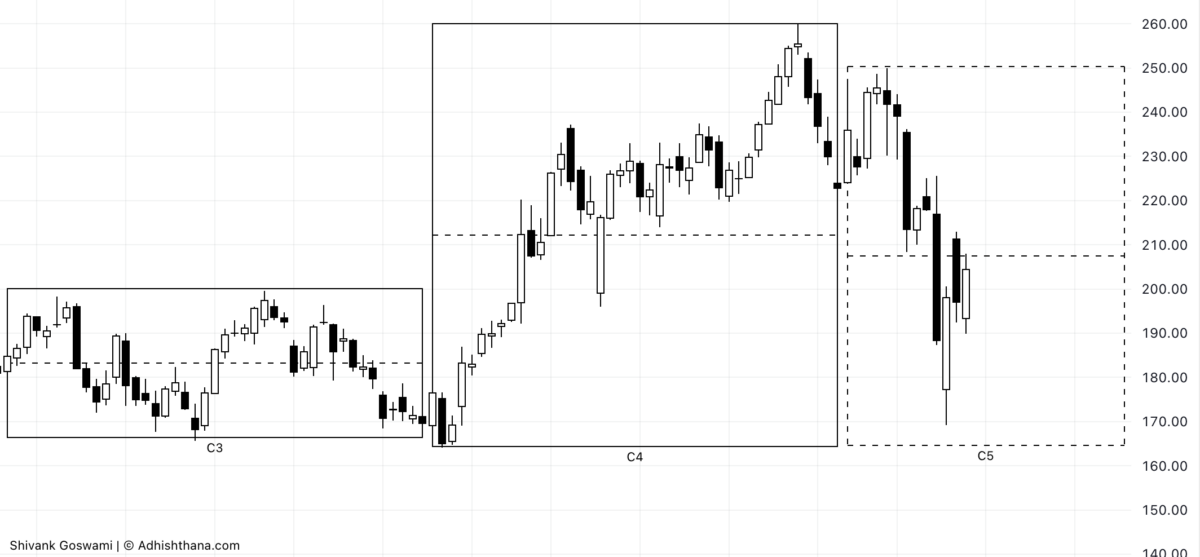

Apple Inc. AAPL is scheduled to report its Q2 2025 earnings on May 1st. Analyzing the charts reveals insights based on the Adhishthana Principles.

Current Market Trends and Analysis

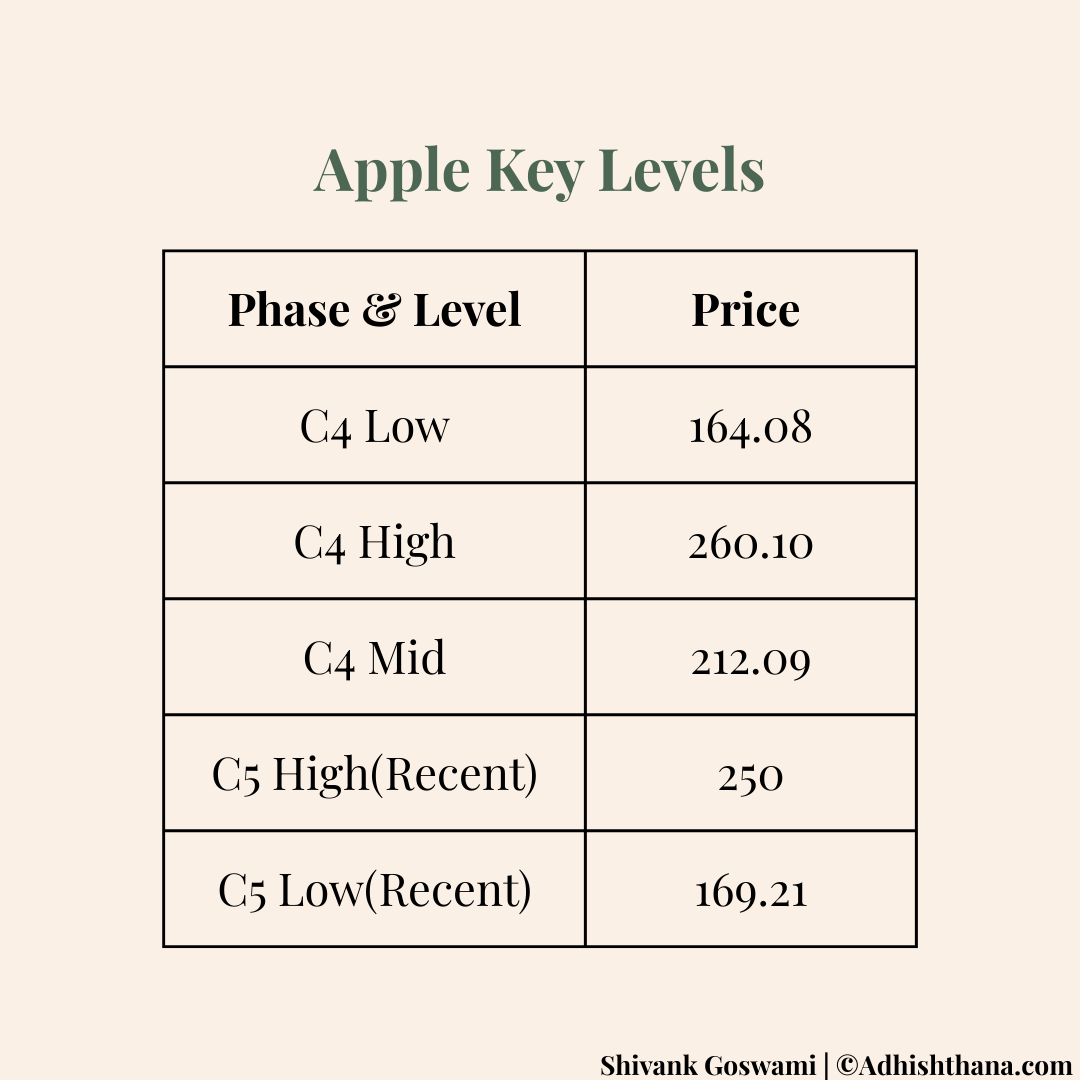

At present, Apple is trading within the C5 phase of its Adhishthana market cycle. In this stage, a test of the prior C4 phase low at $164.08 is anticipated. After starting C5 at $224.02, the stock climbed to an interim high of $250.00, only to reverse sharply. Recently, it bottomed at $169.21, nearing the C4 low.

Structural Implications for Upcoming Trading Sessions

Considering these technical levels, the C4 low of $164.08 is expected to act as a strong support during the volatile trading sessions ahead of earnings.

The current C5 phase has manifested eight red bars, indicating a likely final downward move before the market structure shifts. The C4 low is expected to continue providing stabilization as support.

Behavior of Apple’s stock price in the upcoming sessions will be crucial in determining the pathway of the next five-phase Cakra cycle, significantly influencing the medium-term trajectory of the stock.

Fundamentals Overview

In the last quarter, Apple reported revenue of $124.3 billion. Operating income was $42.83 billion, with total operating expenses at $15.44 billion. The net income reached $36.33 billion, resulting in earnings per share (EPS) of $2.41. From an analytical standpoint, an EPS of $2.52 in the upcoming report would indicate positive reinforcement of Apple’s alignment with the Adhishthana framework.

As Apple’s price behavior approaches key structural supports, there are 40 weekly bars remaining until the potential discovery of the Nirvana level in C6. The stock’s next steps could greatly define the trajectory of its upcoming market cycle.