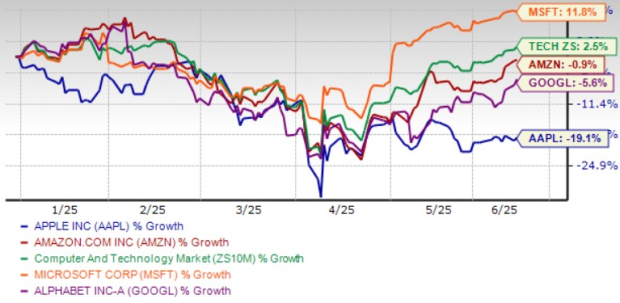

Apple recently showcased multiple updates for its platforms, including iOS 26, macOS Tahoe 26, and watchOS 26, at the Annual Worldwide Developers Conference (WWDC). Alongside these updates, Apple introduced a new software design using a material called Liquid Glass, enhancing app experiences by adapting to various light conditions. While these features will be available for testing soon and are expected to launch this fall, Apple’s newly introduced AI capabilities reportedly lack a significant impact compared to rivals like Microsoft and Amazon. Apple shares have declined 19.1% year-to-date, while the Zacks Computer & Technology sector has reported a 2.5% increase.

Apple’s fiscal performance shows a challenging landscape, particularly in China, where iPhone sales saw a 2.3% year-over-year drop amid increasing competition. Current tariffs are expected to cost Apple about $900 million in Q3 2025, with a gross margin projected between 45.5% and 46.5%. Despite the flagship iPhone’s challenges, Apple’s Services segment reported an 11.6% year-over-year revenue growth, and subscriber numbers across its platforms have surpassed 1 billion globally, driven by the popularity of Apple Music, Apple TV+, and Apple Pay.

Current estimates for Apple’s fiscal 2025 earnings indicate a slight decline in expectations to $7.11 per share, reflecting a growth rate of 5.33%. With a Price/Sales ratio of 7.3X, which stands out as relatively high compared to the sector, investors are advised to approach AAPL cautiously, given current market conditions and the stretched valuation.