Avantis Responsible U.S. Equity ETF Shows Potential Growth

In an analysis by ETF Channel, we looked at the Avantis Responsible U.S. Equity ETF (Symbol: AVSU) and compared its holdings against analyst target prices. The estimated target for the ETF is set at $77.26 per unit.

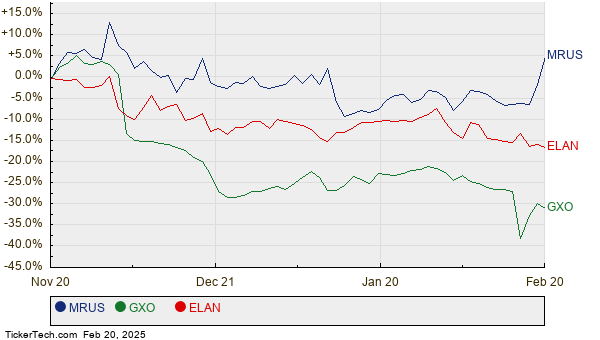

Currently, AVSU trades around $69.06, suggesting an 11.87% upside based on these analyst forecasts. Among its top holdings, notable stocks with significant potential include Merus NV (Symbol: MRUS), GXO Logistics Inc (Symbol: GXO), and Elanco Animal Health Inc (Symbol: ELAN). For instance, MRUS, trading at $45.07, has an average analyst target of $86.12, reflecting a 91.09% increase. Similarly, GXO could rise 51.79% from its current price of $40.44 if it meets the target price of $61.38. Analysts also expect ELAN to climb 50.36% from its recent valuation of $11.24 to reach a target of $16.90. Below is a visual representation of the twelve-month stock performance for MRUS, GXO, and ELAN:

Here’s a summary of the current analyst targets for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Avantis Responsible U.S. Equity ETF | AVSU | $69.06 | $77.26 | 11.87% |

| Merus NV | MRUS | $45.07 | $86.12 | 91.09% |

| GXO Logistics Inc | GXO | $40.44 | $61.38 | 51.79% |

| Elanco Animal Health Inc | ELAN | $11.24 | $16.90 | 50.36% |

These target prices lead to questions about whether analysts are being realistic or overly optimistic regarding future stock performance. Investigating the context behind these estimates is crucial for investors. A large gap between a stock’s current price and the analyst target could indicate growth potential, but it’s essential to assess whether the targets reflect recent industry shifts or if they stem from outdated assessments.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• CPAA Videos

• Top Ten Hedge Funds Holding LNFA

• DD Technical Analysis

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.