Analyzing Wall Street’s Recommendations for Celestica (CLS)

Investors often look to Wall Street analysts for guidance on whether to buy, hold, or sell stocks. Changes in ratings from these brokerage-firm-employed analysts can significantly impact a stock’s price. But how reliable are these recommendations?

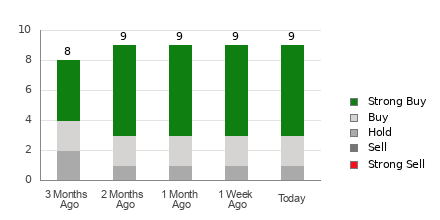

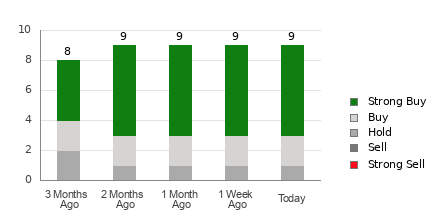

In the case of Celestica (CLS), investors will find an average brokerage recommendation (ABR) of 1.44, measured on a scale of 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This rating is derived from the recommendations of nine brokerage firms and suggests a leaning just between Strong Buy and Buy.

A closer look reveals that out of the nine recommendations contributing to the current ABR, six are classified as Strong Buy and two as Buy. Therefore, Strong Buy and Buy options represent 66.7% and 22.2% of all recommendations, respectively.

Current Brokerage Recommendations for CLS

Explore price targets & stock forecasts for Celestica here>>>

Despite the ABR suggesting a positive stance on Celestica, it’s essential for investors to dig deeper rather than relying solely on these ratings. Research has often indicated that brokerage recommendations are not very effective in helping investors pinpoint stocks with significant potential for price appreciation.

Why is this the case? Brokerage analysts carry vested interests in the stocks they cover, leading to a noticeable positive bias in their ratings. Research shows that for every “Strong Sell” recommendation, brokers tend to issue five “Strong Buy” ratings.

This discrepancy creates a misalignment between the interests of brokerage firms and retail investors, thus providing limited insight into a stock’s future price direction. Therefore, it’s advisable to treat this information as a complement to your own analysis or other robust stock prediction tools.

Our proprietary tool, the Zacks Rank, is one such resource. It relies on a quantitative model that evaluates earnings estimate revisions and classifies stocks into five categories, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This tool has demonstrated consistent reliability in predicting a stock’s near-term price performance. Cross-referencing the Zacks Rank with ABR can be instrumental in making well-informed investment decisions.

Understanding the Differences: ABR vs. Zacks Rank

It’s crucial to know that while both the Zacks Rank and the ABR operate on a scale from 1 to 5, they are fundamentally different metrics.

The ABR solely reflects the ratings assigned by brokers, typically expressed in decimal form (like 1.28). In contrast, the Zacks Rank is grounded in earnings estimate revisions and is indicated by whole numbers from 1 to 5.

Brokerage analysts tend to be overly optimistic in their recommendations due to their firms’ interests. Consequently, they may issue more favorable ratings than their research justifies, leading to potential investor misguidance.

On the other hand, the Zacks Rank is closely tied to earnings estimate revisions, with historical data showing strong correlations between these revisions and short-term stock price movements.

Additionally, Zacks Rank updates are timely and efficiently reflect analyst revisions for current-year earnings estimates. This ensures that the tool remains relevant in predicting future stock prices, unlike the potentially outdated nature of the ABR.

Should You Invest in CLS?

For Celestica, recent earnings estimate revisions show that the Zacks Consensus Estimate has remained steady at $4.78 over the past month.

This stability in analysts’ consensus regarding the company’s earnings could indicate that the stock might perform similarly to the broader market in the near term.

Due to the small change in the consensus estimate along with three other related factors, Celestica currently has a Zacks Rank #3 (Hold). For those interested, you can find a list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Given the ABR of Buy for Celestica, investors should approach with caution.

Zacks Highlights Top Semiconductor Stock

In the semiconductor sector, Zacks has identified a stock that is merely 1/9,000th the size of NVIDIA, which has surged over +800% since receiving a recommendation. Although NVIDIA remains solid, this new contender shows significant growth potential.

With robust earnings growth and a widening customer base, this company is well-aligned to meet the increasing demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is projected to grow from $452 billion in 2021 to $803 billion by 2028.

Discover this stock now for free >>

Free Stock Analysis Report for Celestica, Inc. (CLS)

Originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.