Top Tech Stocks Rising: Alibaba, Palantir, and Vertiv Shine

Several stocks have attracted significant attention lately, particularly Alibaba (BABA), Palantir (PLTR), and Vertiv (VRT). This article examines each company and how they currently compare in the market.

Alibaba Shares Experience Strong Rebound

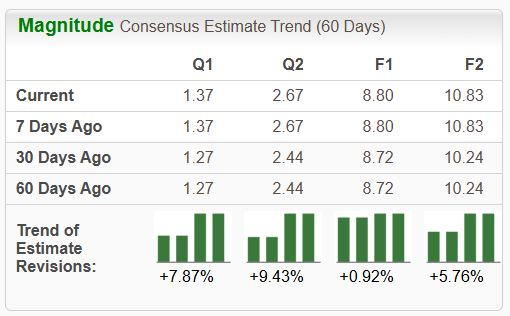

Alibaba’s stock has shown considerable strength since late January, buoyed by news of a new AI model that reportedly surpasses DeepSeek. The company’s earnings per share (EPS) outlook remains promising, a crucial factor in its short-term stock performance.

The stock currently holds a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

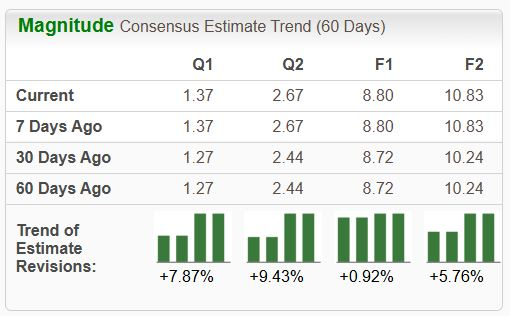

Significantly, revenue from its AI-related products has maintained a triple-digit year-over-year growth rate for the sixth consecutive quarter. Overall sales growth for BABA has shown modest acceleration in recent periods, as illustrated below.

Image Source: Zacks Investment Research

With nearly a 70% increase in 2025 alone, this recent momentum has been notably welcomed by shareholders, especially after years of downward trends.

Palantir Delivers Strong Financial Performance

Palantir also delivered impressive results, surpassing expectations with significant growth. The company reported sales of $828 million, up 36% year-over-year and 14% sequentially. Notably, customer count saw a remarkable 43% increase, reflecting rising demand for its services.

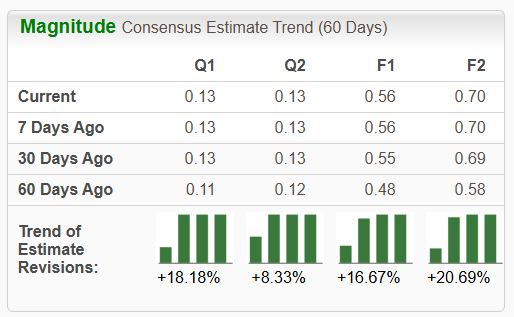

Similar to Alibaba, analysts are optimistic about Palantir’s prospects, giving it a Zacks Rank #2 (Buy). For the current fiscal year, EPS is projected to increase by 36%, with sales expected to rise by 32%.

Image Source: Zacks Investment Research

Palantir also achieved a record-setting total contract value (TCV) of $803 million in the U.S. commercial sector, increasing 130% year-over-year and 170% sequentially. Both Commercial and Government revenue exhibited strong growth, up 64% and 45%, respectively.

Vertiv Maintains Excellent Sales Growth

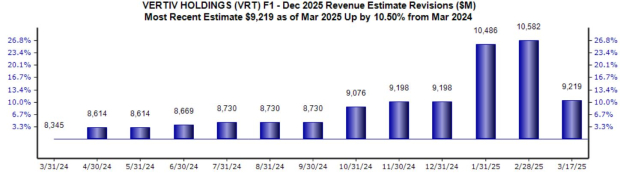

Vertiv has consistently reported solid growth, with EPS climbing 77% backed by a 26% rise in sales during its latest reporting period. The company has demonstrated impressive top-line growth, as evidenced below.

Image Source: Zacks Investment Research

Additionally, Vertiv revised its full-year 2025 sales guidance upward, now indicating roughly 16% year-over-year growth. Sales estimates for the current fiscal year have received numerous positive revisions throughout the past year, as depicted below.

Image Source: Zacks Investment Research

Conclusion

Noteworthy stocks like Alibaba (BABA), Palantir (PLTR), and Vertiv (VRT) have gained considerable attention. All three companies are connected to the growing interest in AI, although Alibaba’s shares suggest a broader recovery in the Chinese market.

7 Best Stocks for the Next 30 Days

Experts have unveiled a list of seven elite stocks from the current Zacks Rank #1 Strong Buys. They believe these stocks are “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market, averaging gains of +24.3% per year. Investors should pay close attention to these handpicked selections.

For the latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click for your free report.

Alibaba Group Holding Limited (BABA): Free Stock Analysis report

Vertiv Holdings Co. (VRT): Free Stock Analysis report

Palantir Technologies Inc. (PLTR): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.